15Feb1:14 pmEST

Which Market is Your Way, Frank?

After a fairly obvious fade at the same area we saw swift rejection last week--The 50-day simple moving average on the S&P 500 Index--stocks are regrouping rather well as I write this.

While the Nasdaq is outpacing the other major averages today, I still have an eye on the small caps in the IWM for clues. After all, the IWM was the key to yesterday morning's upside reversal, and was also the first index to flip red this morning on the fade.

But now IWM is nearly back to session highs, as early morning bears may have trapped themselves for now.

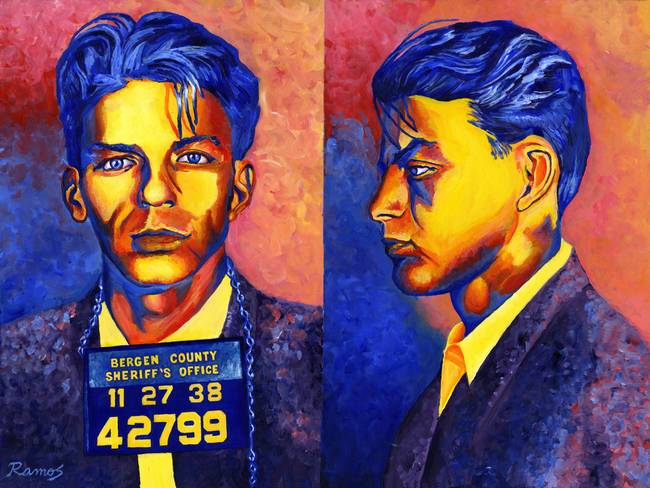

In the meantime, bulls most likely want to see equities take the Nice n' Easy approach, like famous Sinatra song, and calm down while the VIX collapses. A few days of basing just at or even under the 50-day on the S&P in lieu of a rollover would be just fine, provided that we continue to see a fair amount of quality charts continue to act well.

Alternatively, bears want to see "Something Stupid," another Sinatra song, in the form of the many whipsaws we have seen today eventually lead to a nasty selloff into the closing bell.

With the likes of AAPL AMZN NFLX acting as well as they are here, bears continue to have their work cut out for them. Biotechs are also an issue for bears, with the XBI back above all daily chart moving averages.

More on this, with specific ideas, in my usual Midday Video for Members.

Sunday Matinée at Market Ch... War is Hell But This Market ...