29Jan11:11 amEST

Frozen in Real Time

Ahead of the big events of the week, such as AAPL FB AMZN earnings the next three evenings, respectively, on top of the FOMC and GDP print tomorrow, equites are essentially sloshing around in a new short-term range we have been establishing over the last week and a half or so.

Weakness in Square is being attributed to a negative analysis report this morning, as SQ is off by more than 9% as I write this and clearly dampening the mood in tech. Still, it is tough to draw too many inferences from this price action so far when you consider the action-packed events yet to come this week.

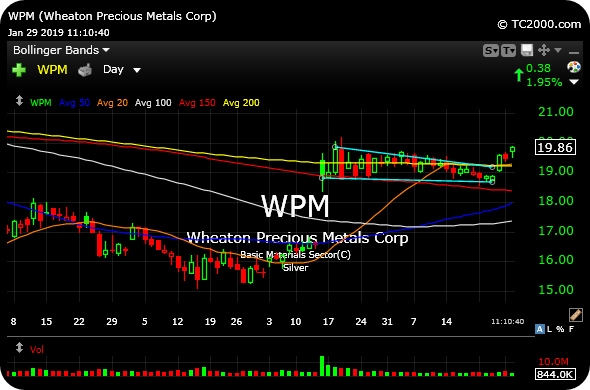

On the precious metals and mining front, steady improvement seems to be the theme of late. Wheaton is a name I am long both in my trading and long-term accounts, with price attempting to push up and away from the tight base highlighted on the WPM daily chart, below. Note how that base dealt adequately with a smoothing-out 200-day moving average.

This is preciously the type of action gold bugs have been yearning for, in terms of making actual progress from a technical standpoint beyond the same macro arguments about money printing and inflation.

Overall, equities are frozen in time ahead of some heavy action-filled events this week which could easily heat up the tone and tenor of the market environment.

Stock Market Recap 01/28/19 ... X Marks the Spot for XME Nam...