20Sep11:00 amEST

Summer Into Fall, Make the Call

Today marks the last trading day of summer, with autumn in the Northern Hemisphere beginning on

Monday, September 23rd.

Although the post-Labor Day phase has been in gear for a few weeks now, and the Fed meeting is in the rear view mirror, stocks are still searching for a more definitive clue as to whether or not they should sustain a meaningful leg higher from here.

As I write this, for example, the QQQ ETF is back to red with visible growth stocks like NFLX ROKU XLNX getting beat up again today. The mega caps in the Dow and the small caps in the IWM are green, however, and trying to pick up the slack.

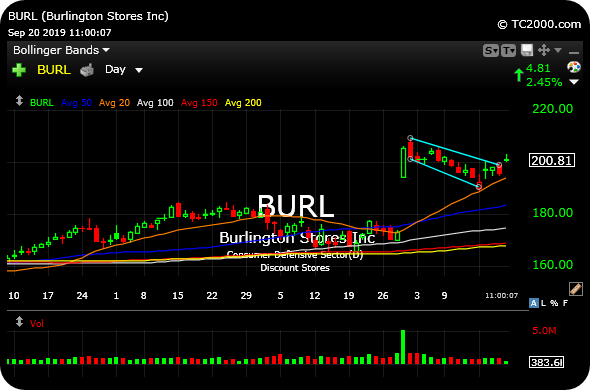

The net result is a slow-as-molasses tape once again, albeit with some pockets of interesting action. Burlington Stores Inc., in retail, is an underrated chart which is off to a strong star this morning. Holding above $200 will be key, as seen on the BURL daily chart, below. Again, much of the success of breakout plays like BURL hinges on the broad market health. In terms of dip-buying plays, GH in healthcare is back down to its 200-day moving average for the first time in several quarters.

A Market Speaking with a Sou... Midday Analysis 09/23/19 {Vi...