01Oct3:29 pmEST

So Close You Can Almost Taste It

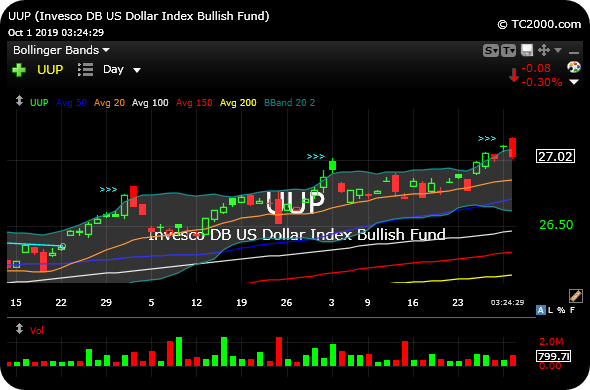

Quick note into the bell here as the Nasdaq tries to offset small cap damage today: Note how exhausted the U.S. Dollar looks today, clearly short-term overbought on the UUP ETF daily chart (UUP is simply the U.S. Dollar versus a basket of developed economies' currencies).

As you know, the Dollar and gold often have an inverse relationship, but not always.

Still, if UUP cools off here, gold and her miners are making a case today with a solid bounce that they may be ripe to resume higher after the recent pullback seemed to have served its purpose of instilling doubt in a great many skeptics of the rally from the summer.

We have been tracking the GDX bearish daily chart versus constrictive weekly chart dilemma of late. And if the Dollar follow-through lower from today's reversal candle at overbought, we should become much more serious at reinitiating some miner longs, regardless of what equities do going forward.