13Nov10:59 amEST

It's Not OK to Overlook Snap, Boomer

Late-last year shares of SNAP slumped as low as a $4-handle, easily one of the more ferocious decline during the broad market fourth quarter correction of 2018, with bears declaring the name to be imminently dead and a social media/app fad which had since run its course.

Since then, however, the stock literally "snapped" back hard, rallying in a fairly straight line higher until late-July of this year before finally cooling off. On the updated weekly chart of SNAP, below, we can see that the subsequent consolidation has taken on an orderly look, with the lion's share of gains from earlier this year still very much intact.

Going forward, I am on watch for a resumption of SNAP's 2019 strength to put the cherry on top of what has been a very successful year for the app which is seemingly synonymous with the millennial generation. Admittedly, I am not a regular user of SNAP and thus am far from a biased bull on the firm and/or stock.

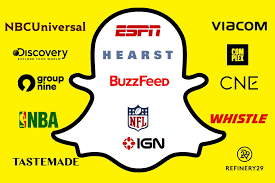

But it is hard not to think that a major deal (SNAP currently has roughly a $20 billion market cap) could be in the cards as the company attracts large corporate brands looking for new ways to connect with the younger generation to get them on the hook as lifelong consumers. Indeed, some very large firms in the Nasdaq could easily bite the bullet and eventually go after SNAP.

In the meantime, I will be stalking a move back over $15.38 to trigger a long entry.

Elsewhere, we have another slow session on the indices as the market digests both Trump and Powell headlines. In and of itself, the major index action is not bearish as we know the indices could have used a breather--We simply need to see the underlying action in equities continue to resist the violent rollovers we saw at various times since May.

Dating Games; Earnings Games Payments Under the Christmas...