03Feb11:03 amEST

Now Comes Your Real Winter Journey

The time period after the Super Bowl is typically when we see the dog days of winter begin to set in. The energy of the holiday season and new year jubilation fades into the distance. And, yet, spring is still too far into the future to think of as something tangible, just yet.

Despite all of the advanced technology in markets today, human emotion is still a powerful force, which makes this time of year all the more important as we know February can often be a rough month for stocks, historically.

Thus, assessing how well the current market can navigate earnings season, the ongoing Coronavirus fears, the twists and turns of a major election year, as well as any other number of concerns will be pivotal as we kick off the new month of trading.

Despite TSLA continuing its daily embarrassment of short-sellers, as well as impressive strength in various biotechs, we need to see the broad market avoid an "open well, close poorly" pattern which we often see during corrective markets. Mind you, I am not referring to a bear market or even a deep correction--The issue is simply whether to add back more long exposure or simply stand pat for me inside Market Chess Subscription Services.

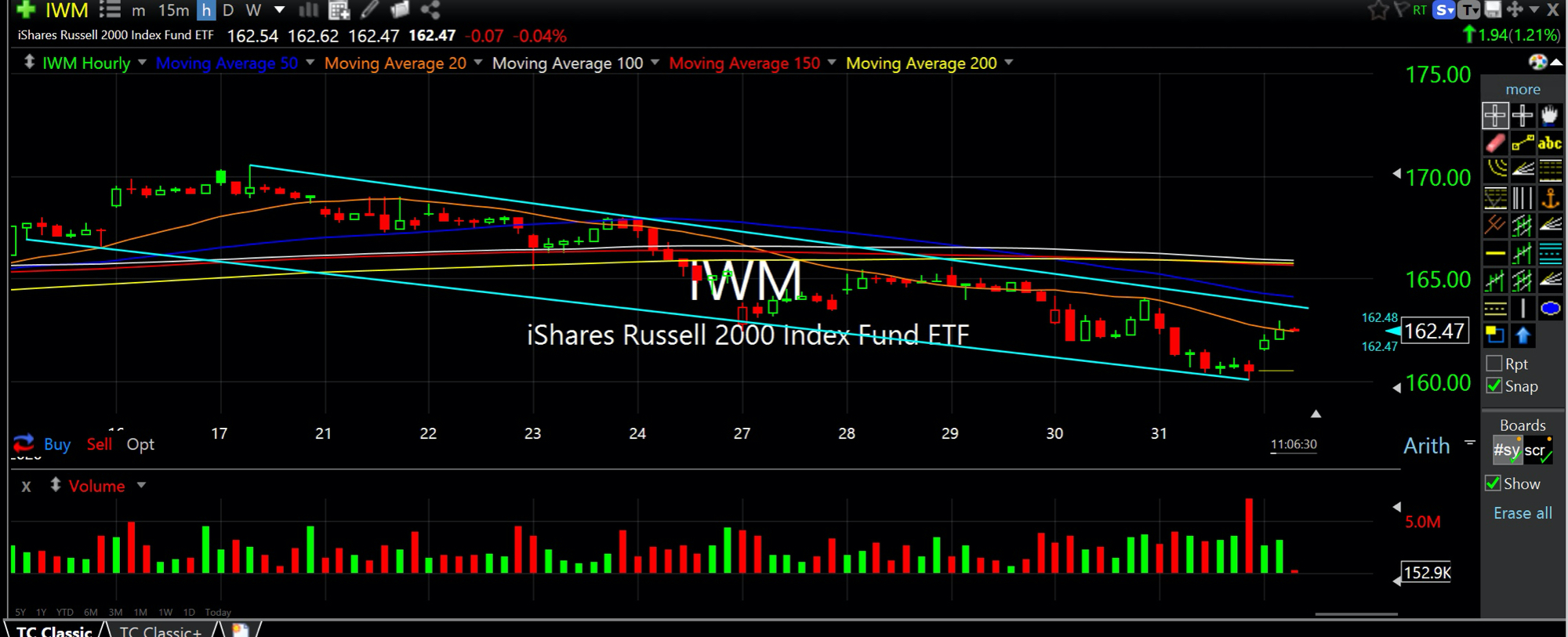

A good visual context for this market right now can be found in the hourly chart for the IWM, ETF of the small cap stocks.

On the IMW hourly, updated below, there is a clear pullback pattern the last two weeks (on this timeframe) of lower highs and and lower lows. Again, this is not bearish per se, given the prior uptrend.

But if this morning's bounce has legs and risk is truly back on, it should be clear from the falling channel lines on this chart that a move back over $165 needs to materialize this week and hold.

You'll Need Backup to Trade ... Isn't That Just Like an Algo...