15Jun3:10 pmEST

Inflation vs. Deflation Struggle

A viable argument can be made that the current market is struggling between whether to levitate on the prospects of inflation expectation or, instead, collapse under the weight of another deflationary spiral. History tells us that, at least on the initial ascent, equities can fare reasonably well in an inflationary environment. However, as the inflation threat rears its true self, and thus ugly nature, gold and various other commodities can often flourish the most. As Milton Friedman famously said, "Inflation is always and everywhere a monetary phenomenon." Hence, The Fed's policies and general attitudes seem to be spawning inflation.

Alternatively, in terms of deflation we equities collapse, be it in the 1930s or in 2008. While it looks and feels terrible, people who have (gasp) been saving and staying off leverage and debt can subsequently afford nice houses and goods as the deflationary spiral plays out (exposing those who are "swimming naked," as Mr. Buffett would say), thus putting an eventual and economically organic end to the negative feedback loop.

Of course, with the type of Fed we have seen since the Greenspan years, they view deflation as the absolute worst outcome. Despite any Larry Kudlow "King Dollar" tropes, The Fed does NOT want a surging U.S. Dollar. If so, it is correlated (or causing) deflationary spirals like we saw in March.

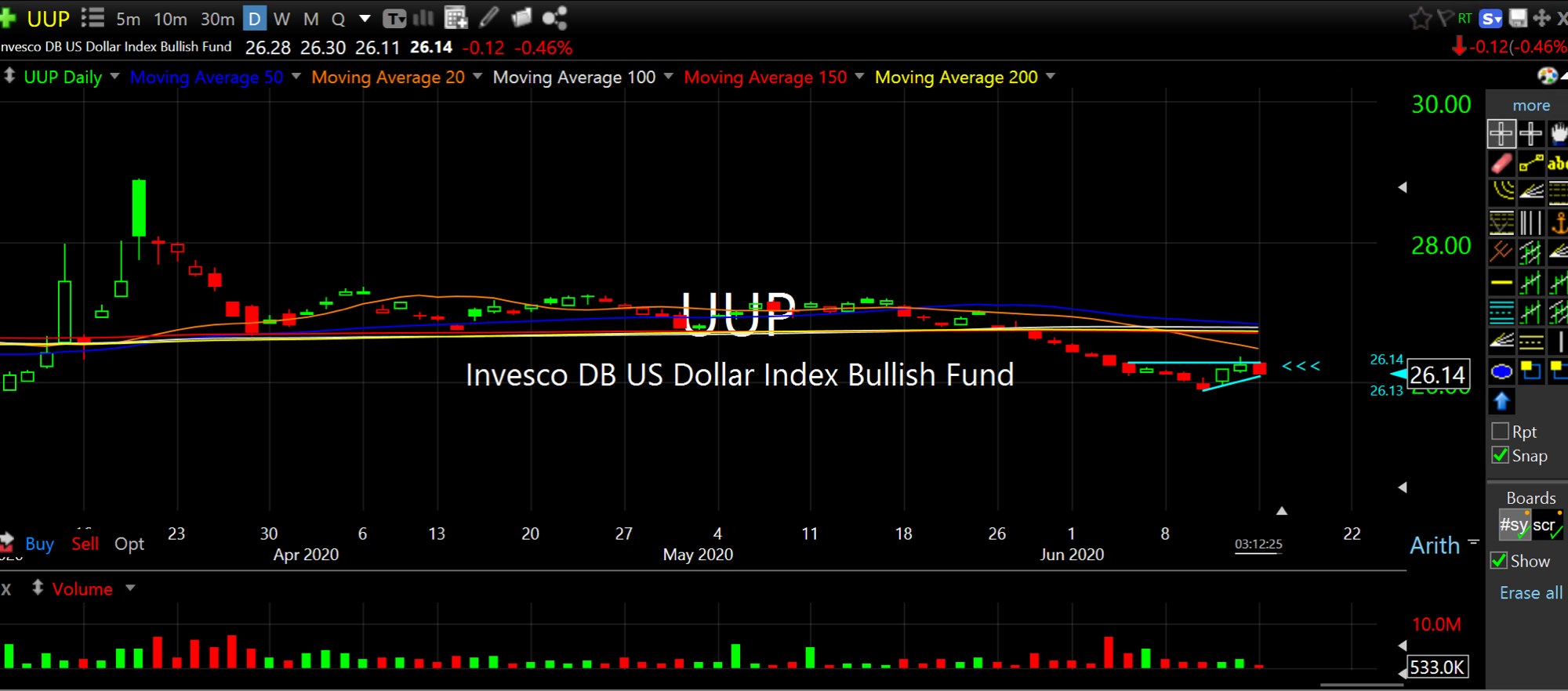

And that brings use to the present moment, with the UUP ETF (the Dollar versus a basket or develop economies' currencies) flipping red today as stocks and gold/miners recover from a deep red morning.

On the UUP daily chart, below, if the recent Dollar bounce (coinciding with, you guessed it, weakness in equities and gold) is a bear flag (highlighted) which breaks lower, then the inflationary scenario is most certainly in play with stocks, at least initially in this cycle, and more likely gold and her miners eventually emerging from a long struggle to become the centerpiece of this cycle.

Can The Fed get what it wants again? So far they have since March (lower Dollar, higher equities, etc.)

But can The Fed really tame the inflation genie once its out of the bottle this cycle? History says not for a long while. Ultimately, the back-and-forth we are seeing is likely the market sorting out which economic and monetary pressures prevail. But I am keying off the current Dollar setup for clues going forward.