19Jun12:28 pmEST

Berries Were Always Better Than Apples Anyway

Call me crazy and brazen (or worse) if you will but I am a short-seller of any firm with a $1.5 trillion (with a T) market cap which subsequently announces they are re-closing stores in states like Florida, Arizona, the Carolinas, etc. due to the recent virus outbreaks there.

I know that Apple has seemingly been un-shortable, a widely-loved and owned name with even the Aw-Shucks-I-Don't-Understand-Tech Warren Buffett owning the firm for years now. However, my thesis is focused more on the current market having some semblance of reality beyond the drug-addict (beholden to The Fed, mostly) vibe it has given off for a few months now. And embedded in that reality is just how problematic and symbolic the re-closings are in a state like Florida which seemed to be well on its way to avoiding a New York-like virus fate. With good fortune, we will not see the hospitalizations nor deaths comparable to the Empire State.

But as far as economic activity is concerned and consumer sentiment, it is hard to see how this sort of news does not have some type of chilling effect on commerce.

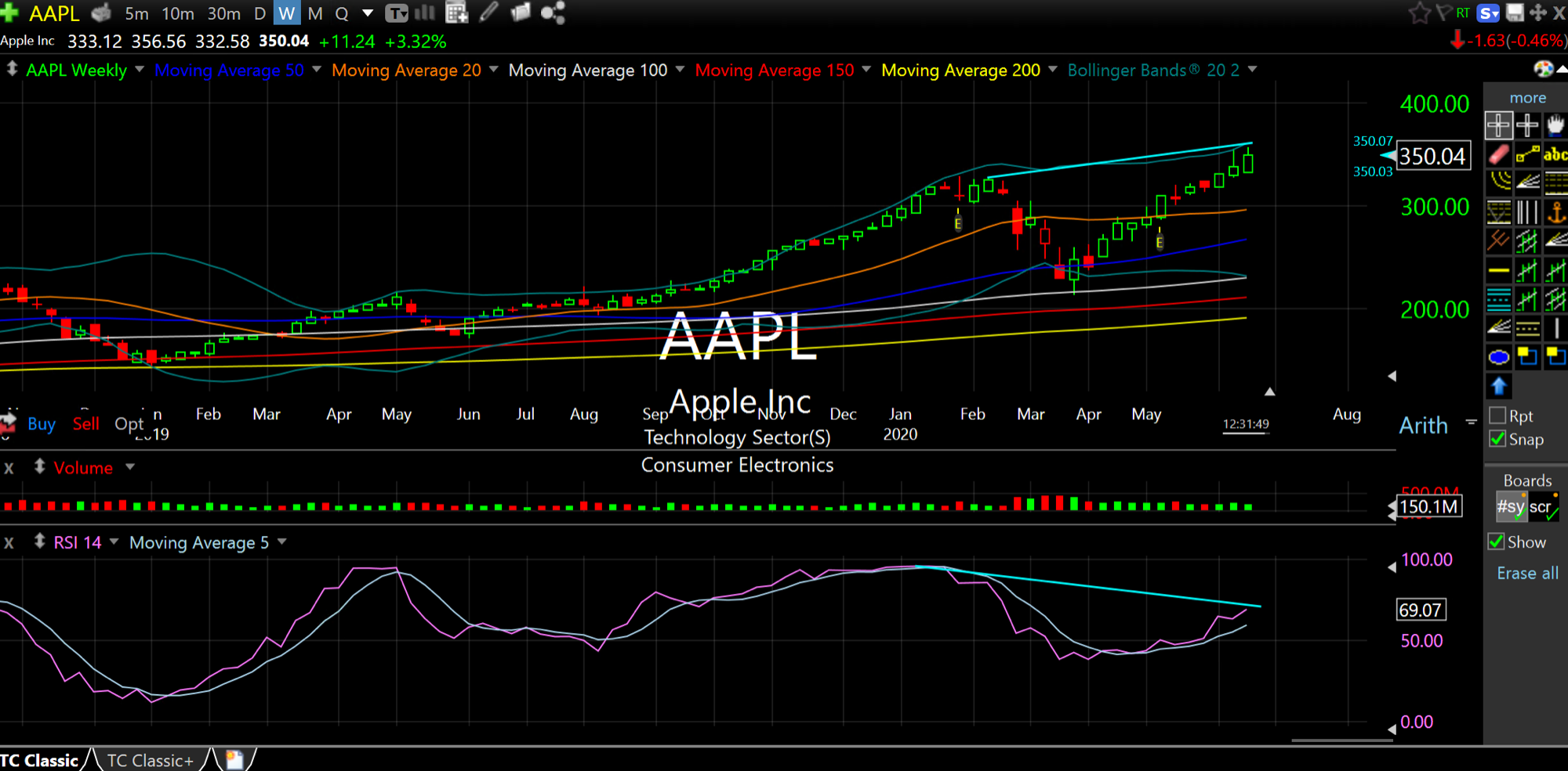

And with AAPL essentially at all-time highs amid a weekly chart bearish RSI divergence (bottom pane of weekly chart, below), I will take my chances for some sharp downside movement into the end of June with a cover stop-loss above $365.

Stock Market Recap 06/18/20 ... Saturday Night at Market Che...