02Nov11:12 amEST

And So it Goes

Regardless of what transpires over the next thirty-six hours or so, the sun will still rise on Wednesday, November 4th, 2020.

It is rather easy, especially in today's frenetic social media plus 24/7 news cocktail of paranoia, to attach the future of civilization to any given election. In reality, though, there is an objective argument to make that the American experiment our Founding Fathers conceived is, perhaps, cresting or even in the beginning stages of a decline. But that is not likely to be known in any given election anytime soon, for sure.

The reason why I raise these points is to provide some levity to one of the more intense years in recent memory for a society at-large.

As for the market, a modest relief bounce is helping to alleviate some concerns from bulls in light of futures opening down last evening. However, the tech leaders in the QQQ ETF are notably lagging this morning, and that may prove to be a legitimate red flag going forward.

On a positive note, BABA in talks to invest in FTCH ought to give e-commerce plays a further boost.

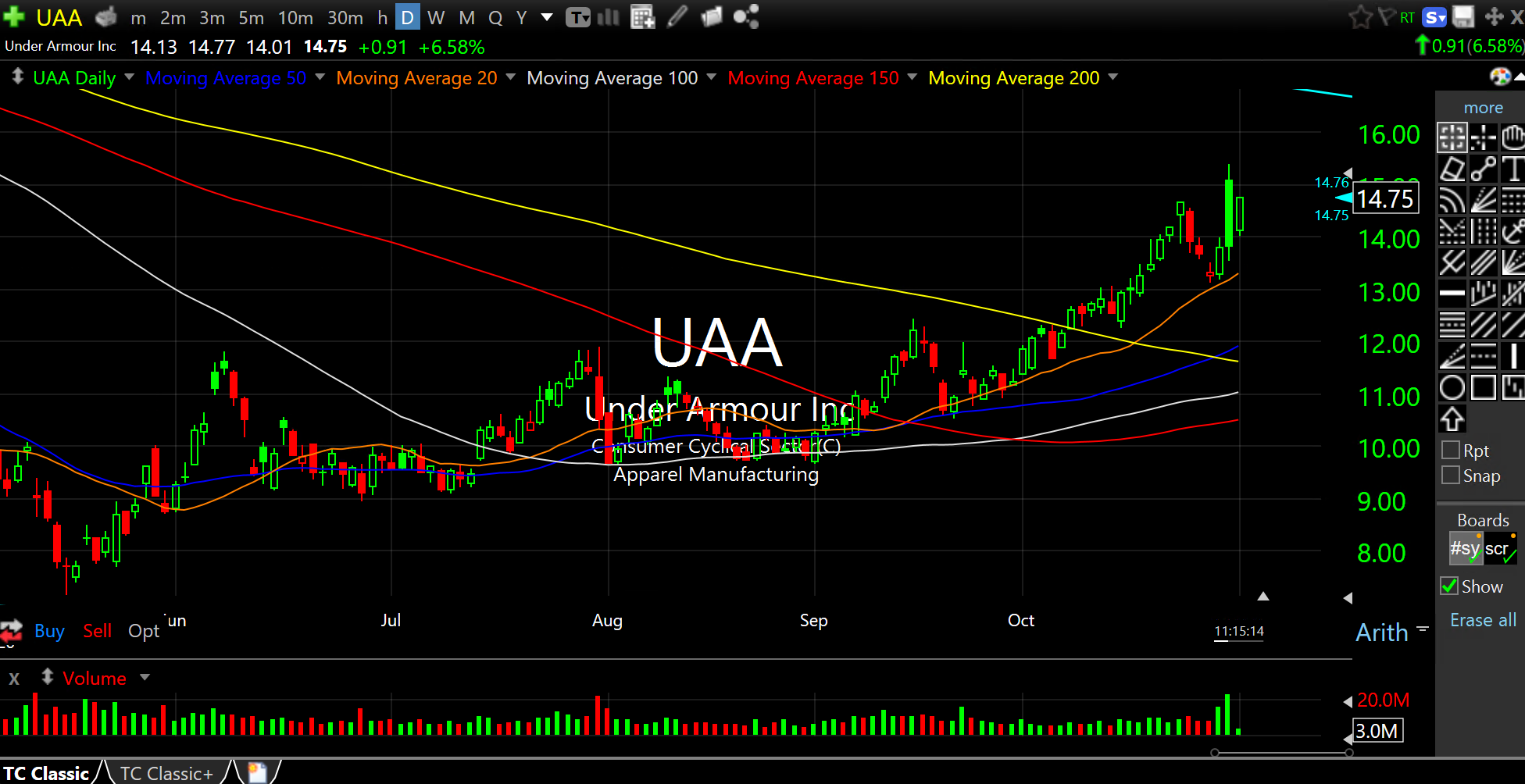

I like the long-term turnaround story for Under Armour, a once-mighty sportswear brand which has been a castaway for a good while now. On the first daily chart, below, after better-than-expected earnings the stock is holding above its 200-day simple moving average (yellow line).

That is important because of the long-term monthly chart, second below, which shows a five-year corrective pattern. I view surprises as being to the upside in this one, as footwear and athletic gear via online shopping should continue to thrive in a pandemic world where casual attire becomes increasingly the norm and people become too restless to keep sitting around after the initial wave of Netflix-ing and chilling.

Weekend Overview and Analysi... Remnants of a Post-Halloween...