08Nov10:35 amEST

Hey, Henry: Here's a Wing!

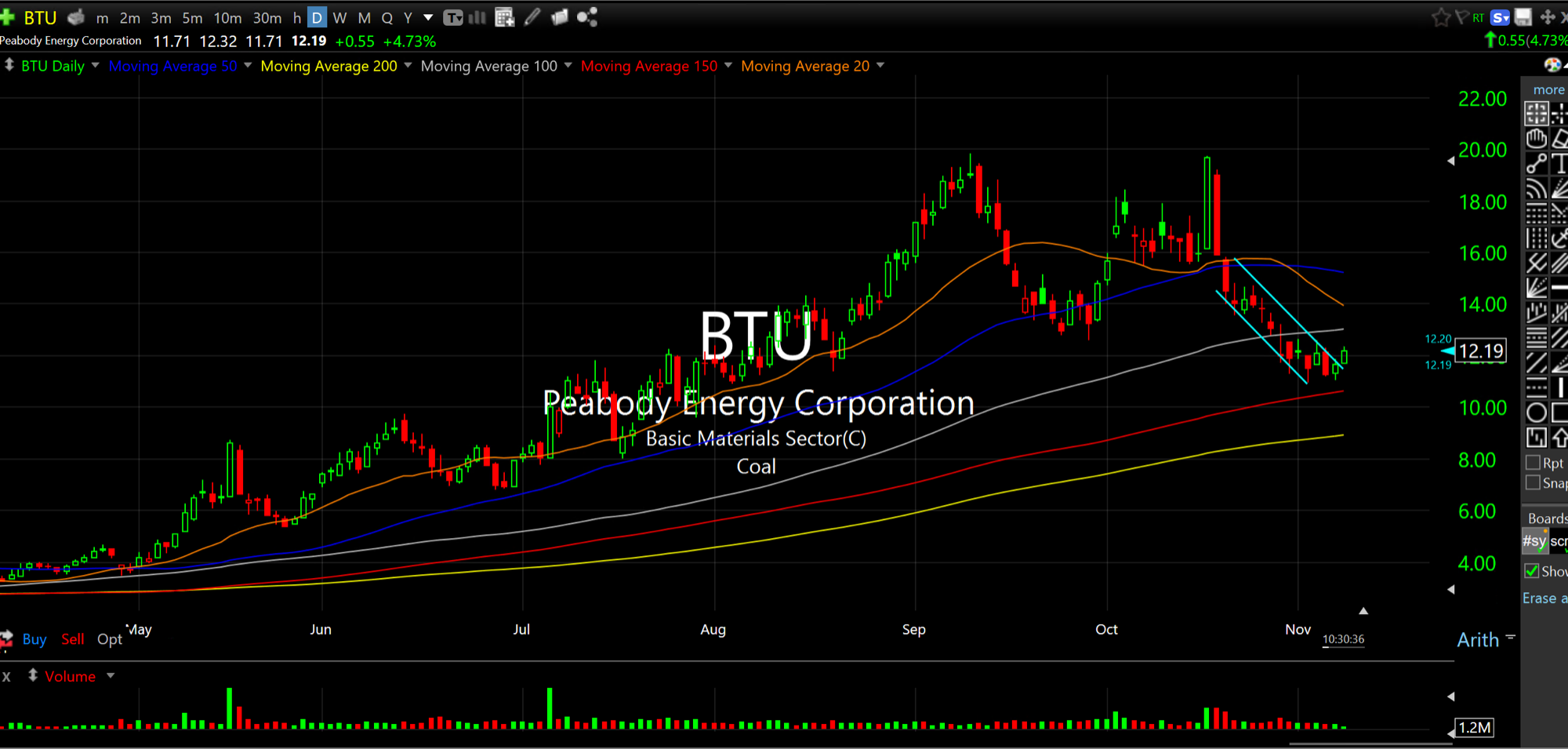

Several weeks back, we were fortunate to sell a BTU long into the enormous green candle seen on the coal firm's updated daily chart, below. Since then, the stock suffered a sickening dive, reminding us all that even if we are in the early stages of a new commodity bull run, volatility in this asset class is unique and violent compared to what we see in most sectors in equities. Indeed, the volatility, especially in Peabody is enough to make anyone queasy like Henry Hill digging up Billy Batts' body several months after the fact.

As it stands now, though, BTU may very well be exhausted going down. I am back on watch to see if the firm can pop up and out of the highlighted falling channel to commence a fresh leg higher--After all, coal stocks are in intermediate-term uptrends, be it names like ARCH or ARLP, the latter one of our Members noted is seeing surging demand.

First things first, and BTU holding over $12 would be a good step for today.

What makes this sector all the more appealing is that it is still flying well below the radar. With TSLA, crypto, other growth stocks and sectors, not to mention pure oil plays all front and center and coal lurking in the background, it is still hard to make a viable argument that this sector is anything close to a crowded trade nor will be for quite some time.