18Nov11:37 amEST

Avoid a One Track Mind

Although many seem hell-bent to focus on crude oil when gauging both inflation and how "commodities are doing" at any given time, as we have profiled here and with Members there are plenty of other commodities which have fared better of late while crude and energy stocks consolidated/dipped. Soft commodities have been a focus for us, and for good reason.

But other plays are worth nothing, too. MP is North America's only pure play rare earth miner, and on the first weekly chart, below, we can see an impressive breakout underway. This firm can, indeed, become a political football of sorts between America and China.

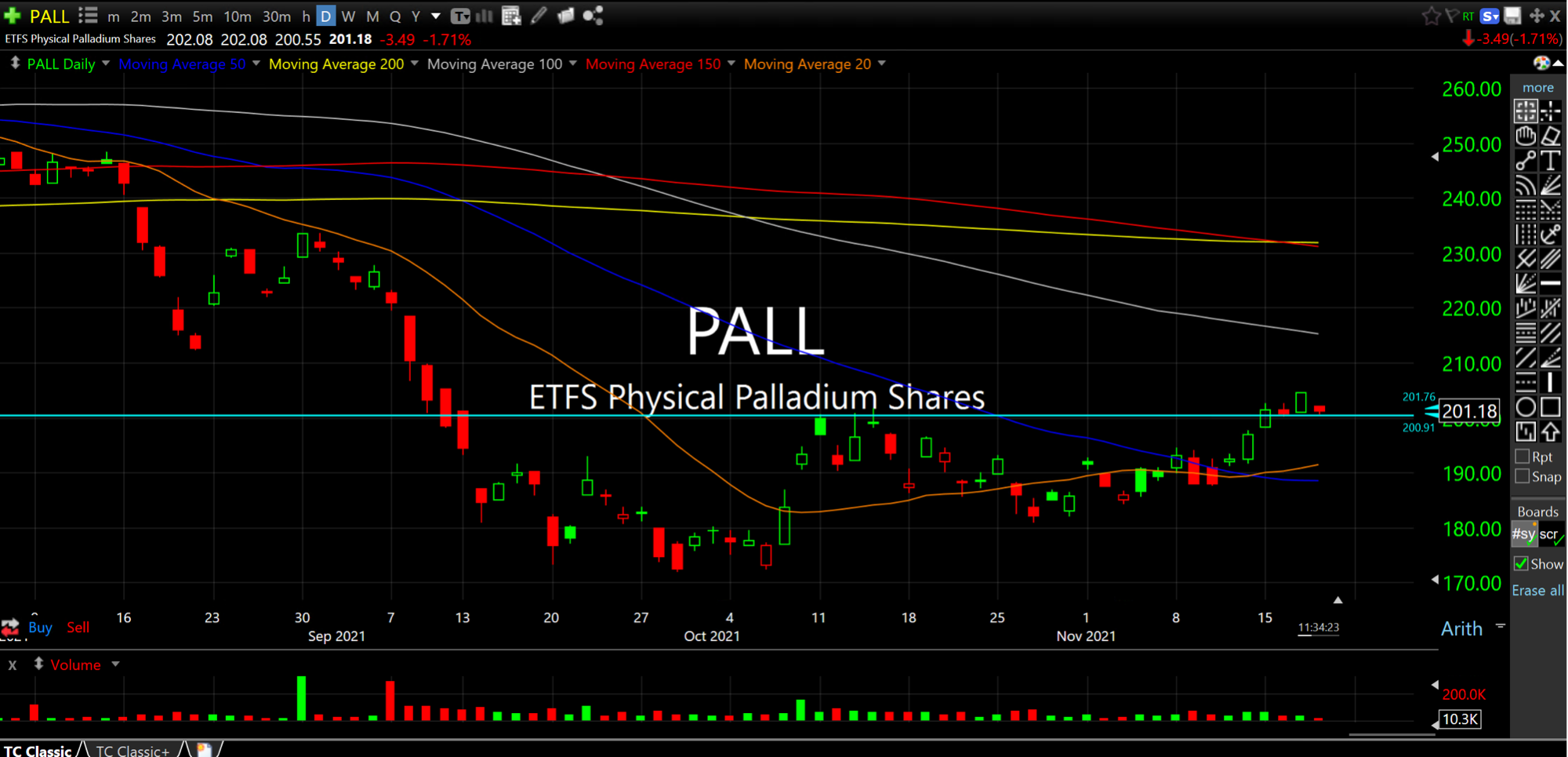

And palladium, second daily chart, is a metal in the platinum family. Note the bottoming potential. PALL, alongside platinum itself, become interesting metals to rally in an inflationary environment, beyond gold and silver. Most palladium winds up being used in catalytic converters, which convert as much as 90% of the harmful gases in automobile exhaust (hydrocarbons, carbon monoxide, and nitrogen dioxide) into harmless substances (nitrogen, carbon dioxide and water vapor).

As for equities, the usual game of mega cap tech masking underlying weakness is in play again, as ARKK (which I went short yesterday) and small caps lags. The game may continue until bulls actually get punished for being so repetitive, uncreative, let alone unsound in chasing up extended, richly valued crowded trades.

But, then again, with the moral hazard The Fed has created in markets, who knows exactly when that reckoning may come.

Waiting to See Their True Co... Keeping the Count with Apple...