18Feb10:37 amEST

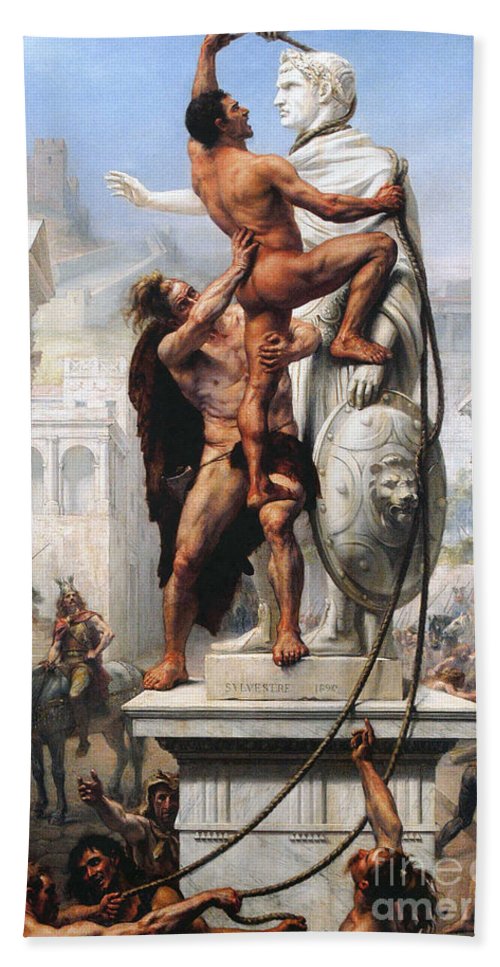

Symbolic Value

Headed into a three-day weekend (markets are closed on Monday in observance of George Washington's birthday, or President's Day) we have some early toggling between green and red across most equities. The latest earnings disasters, like ROKU and RDFN, did not initially weigh down stocks as the overnight pop in futures was hopeful that U.S./Russia talks would cool off the bellicose Putin.

However, that futures pop appears to be long gone.

As I write this, small caps in the IWM ETF are back to red after leading higher out of the gate. And with tech leading lower in the QQQ, it begs the question as to whether longs truly want to hold inventory over the three-day weekend when we could just as early see a nasty headline as a favorable one, all of which is happening as the Nasdaq remains below its 200-day simple moving average.

In my view, TSLA and the semiconductors at-large have not only been the actual victors of the bull run but they also serve as symbols of the bull market, too. At each and every juncture, both TSLA and chips defied skeptics (myself included at times) and kept chugging on higher. With both the SMH ETF and TSLA not sporting vulnerable charts, we have yet another setup where both should break lower. You can be sure bulls will not give them up without a fight, as usual.

But I am not viewing (and trading) them in a vacuum at all, but rather my thought process is that if bulls lose them here it will presage another leg lower in the broad market after the holiday.