28Feb10:50 amEST

Is it Really All Baked Into the Piroshki?

With small caps and the Nasdaq flipping green as I write this off another headline-filled gap down from the weekend, one has to at least wonder if the near-term bad news about Russia and Ukraine has been adequately priced in by markets. While I am always inclined to think that there remain known unknowns--And perhaps some unknown unknowns--about this crisis, the market clearly is not wanting to have a meltdown yet.

Of course, we are just getting started with another fun-fulled week, with the State of the Union tomorrow night followed by Powell's Congressional testimony on Wednesday and Thursday, with the jobs report on Friday to put the cherry on top. And, yes, the battle in eastern Europe can always escalate at a moment's notice.

With this in mind, the uranium stocks are gapping higher to start the week. In and of itself, a seemingly headline-fueled gap up does not always interest me, quite frankly.

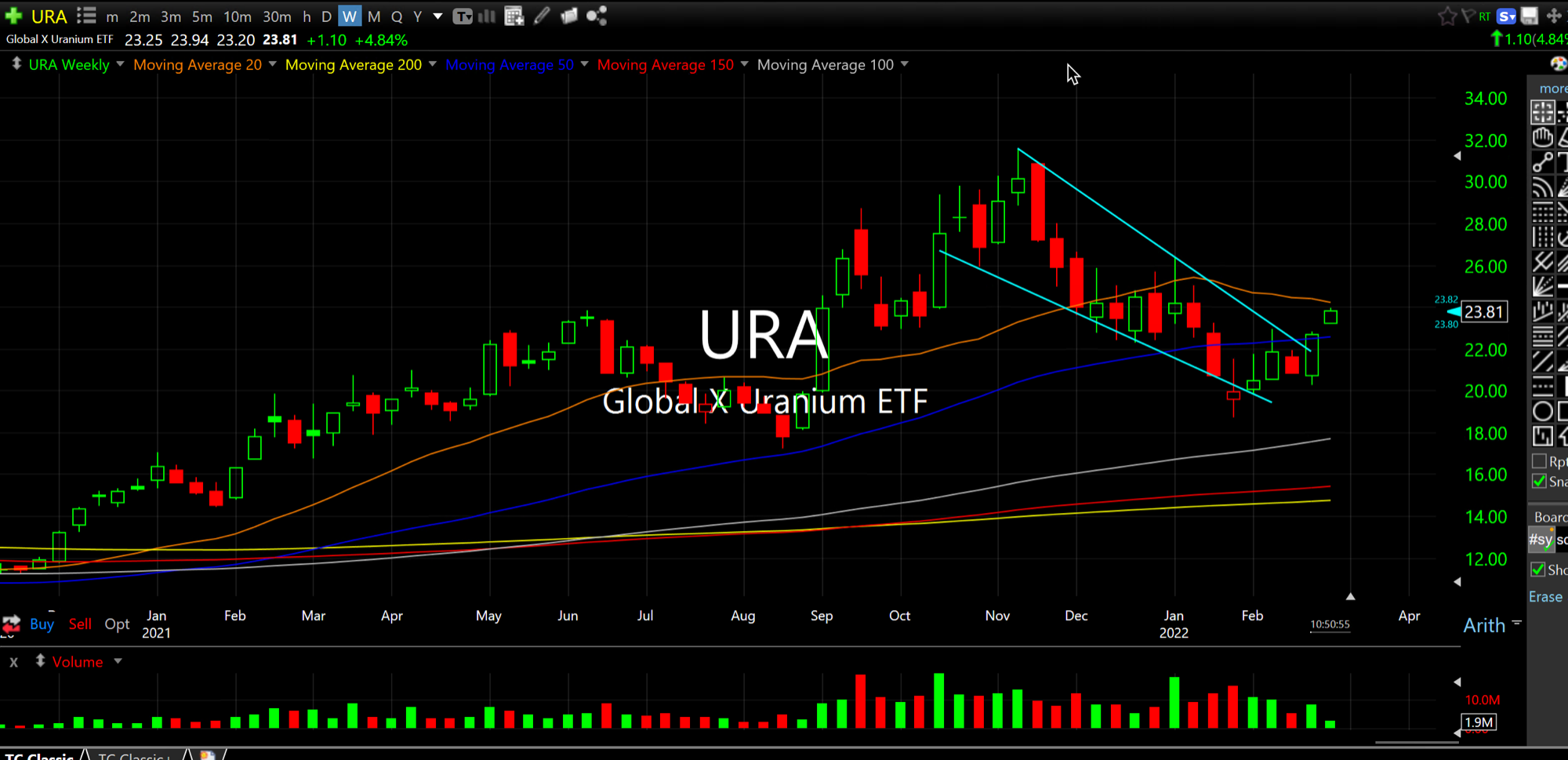

However, in this case, as you can see on the URA, sector ETF for uranium stocks, weekly chart below, the chart was already ripe. And this gap up may very well be a bullish breakaway gap higher up and out of a bullish consolidation from the prior uptrend.

Thus, I am more intrigued by this move than I might normally be, which renders CCJ UEC UUUU and the like all the more compelling on the long side.

Tough Markets Don't Last; To... Rethinking the Oil Trade 03/...