31Mar3:18 pmEST

Looking Out to April and the Second Quarter

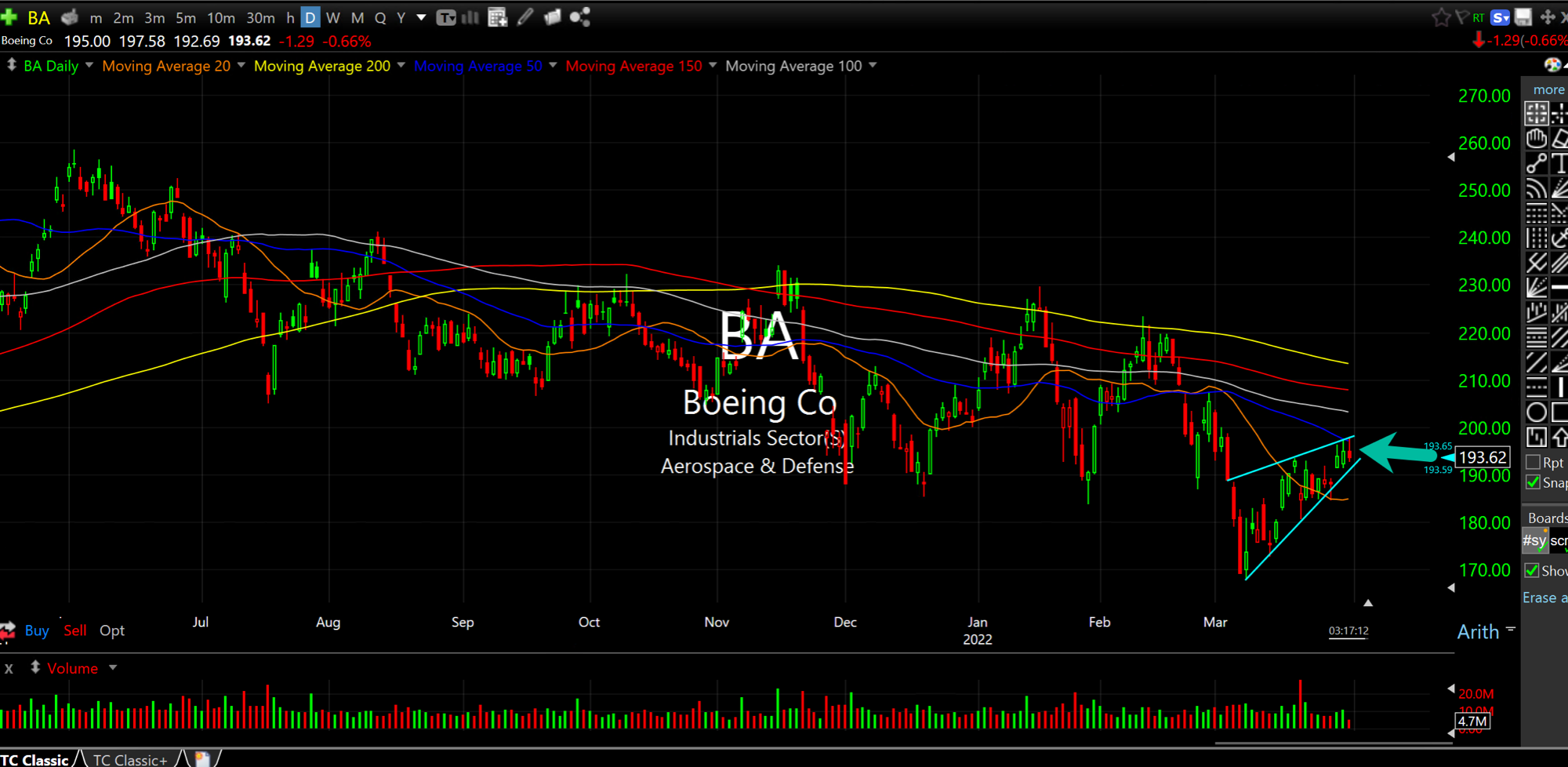

Although sentiment has clearly turned far more sanguine on many parts of equities in recent weeks given the relief rally, looking at a major chart like Dow component, Boeing (BA), below on its daily timeframe, I see sparse evidence of any meaningful bottom. No, I see a clear downtrend with a bounce up to a declining 50-day simple moving average (arrow) amid an airline bounce.

However, as jet fuel prices presumably head higher into summer, not to mention the threat of an economic slowdown as the year unfolds yet, I still see risk to the downside in BA and the airlines. Into Q2, I am looking to see if this thesis pans out.

Note that one of the very best sectors in Q1 was utilities, as the XLU ETF screams higher as I write this and presumably has every fund manager under the sun scrambling to put as many utes on their books as possible. Strong utes is not a great economic indicator of strength, after all.

Finally, note solars outperforming today as oil gets hit on the initial SPR news. ENPH and SEDG are two of the better solar charts, but FSLR and SPWR are acting better and worth a look as we flip the calendar tomorrow.