18Apr3:37 pmEST

I Don't Mind Being "That Guy"

Part of my job, in my quest to deliver value to you, the reader, often involves noting aspects of markets and market players which are inconvenient truths. And, of course, those times where I am wrong it serves as a double-whammy of sorts, where my upsetting of the apple cart proves to be null and void analysis.

Having said that, I continue to have conviction in my view since late-last year that growth stocks and sectors have indeed completed a major bull market top and are currently navigating an established bear market.

Case in point: My morning blog post centered around the glaring weakness in the XBI ETF, which houses plenty of smaller bios and a bunch of Cathie Wood/ARKK names. Even during the various bounces today, the XBI never really got going and is now printing fresh lows in the final hour as I write this.

But for the sake of being objective and thorough, it is not just the XBI, as some bulls suggest.

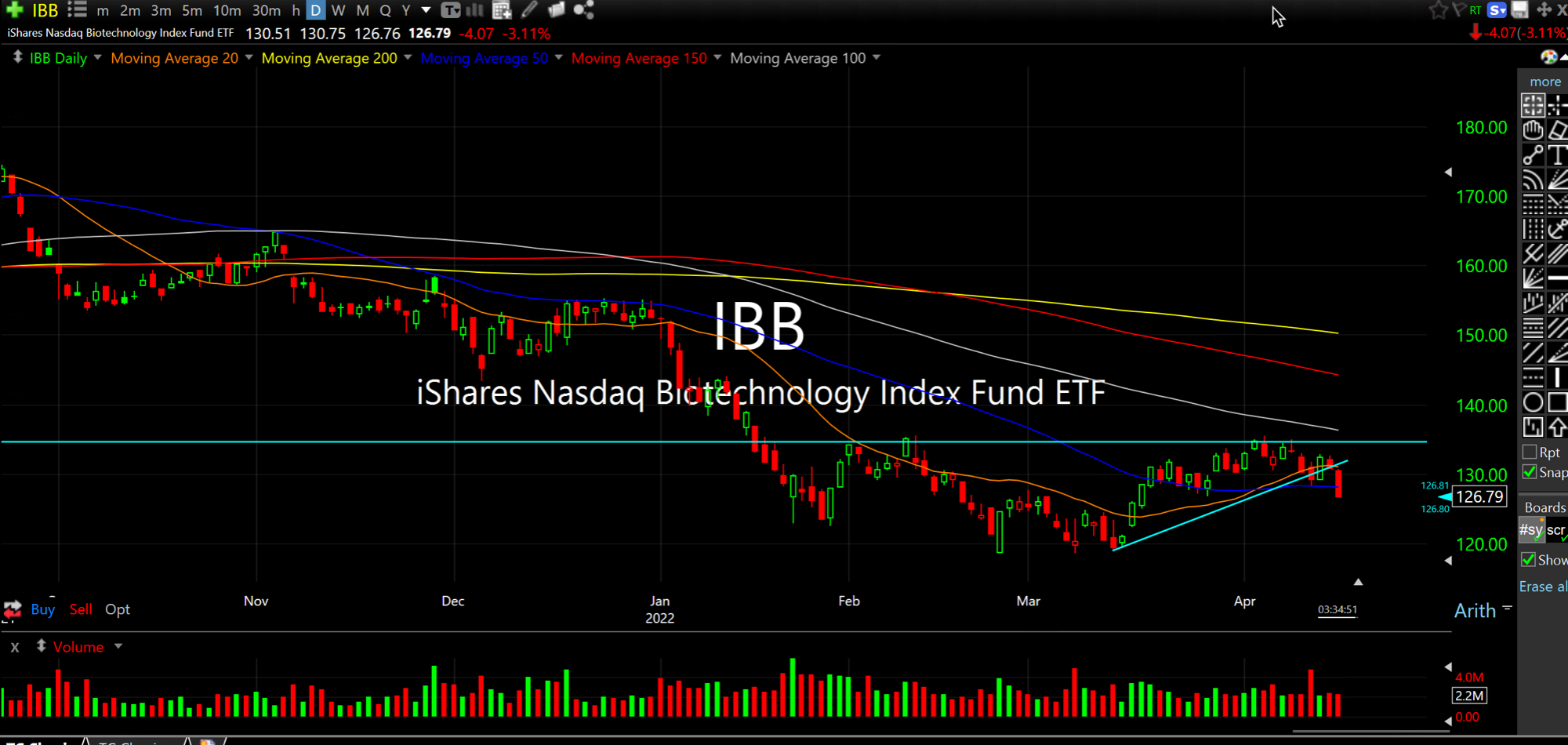

The IBB ETF, below on its daily chart, houses bigger bios and some healthcare crossover giants. Some of the names, like AMGN, actually have been screaming higher in recent weeks as part of a safety trade.

And, yet, as we can plainly see, the IBB cannot hold a bounce and is slicing below its 50-day moving average. I view this as brutally bearish price action, considering the rush to safety in some underlying IBB components, and as a multi-month bearish consolidation about to break to new bear market lows, amid a sea of complacent market players.

As I said, and maybe I am just getting old, but I do not mind being that guy.