21Apr10:02 amEST

I Regret to Inform You

I regret to inform you that this cycle is still about rates, Powell, and inflation, overall, in spite of the day-to-day various headlines about Elon Musk, or just about anything else outside of a nuclear bomb.

Shares of Tesla gapping up 10% this morning after earnings has more than offset a sloppy close by tech yesterday into the bell. However, despite the gap up on the indices this morning, small caps and the likes of the ARK series of ETFs are gap-filling below.

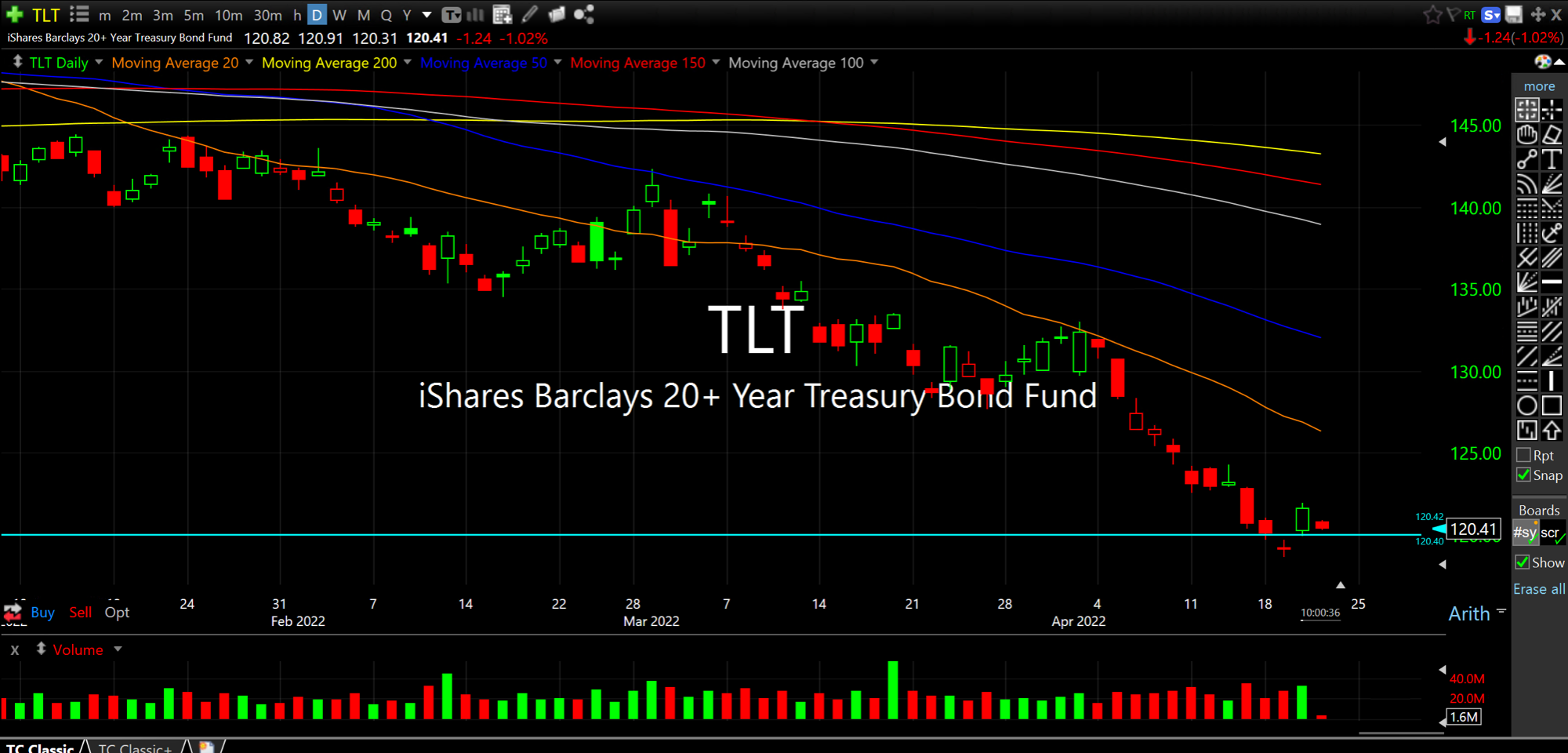

I also find it interesting that rates are pushing back up and, thus, TLT is lower, flying in the face of the plethora of calls I have seen both for peak inflation and peak rates. To my eye, if TLT loses the $120 level, seen below on the updated daily chart for Treasuries prices (inverse to rates), then I expect the recent round of dip-buyers and peak inflation callers to scramble for the exits quickly as we see yet another pop in rates and TLT makes fresh lows.

In reality, and simply put, the divergence between rates on the 10-Year Note, the actual inflation rate, and the Federal Funds Rate is completely out of whack and not likely to be resolves so smoothly.

On that note, we have Fed Chair Powell speaking today, first at 11am EST, then at 1pm EST. His remarks will put the thesis to the test of whether or not we have a new regime in play, with a "Fed Call" instead of a bullish "Fed Put."

In other words, in order to combat inflation, The Fed will talk tough into any rally in stocks in order to blunt it.

Other than that, oil is back at it, with various oil stocks we like trying to sustain breakouts from fairly smooth bases in uptrends.