09May2:38 pmEST

Not Every Safe Stock is Safe Here

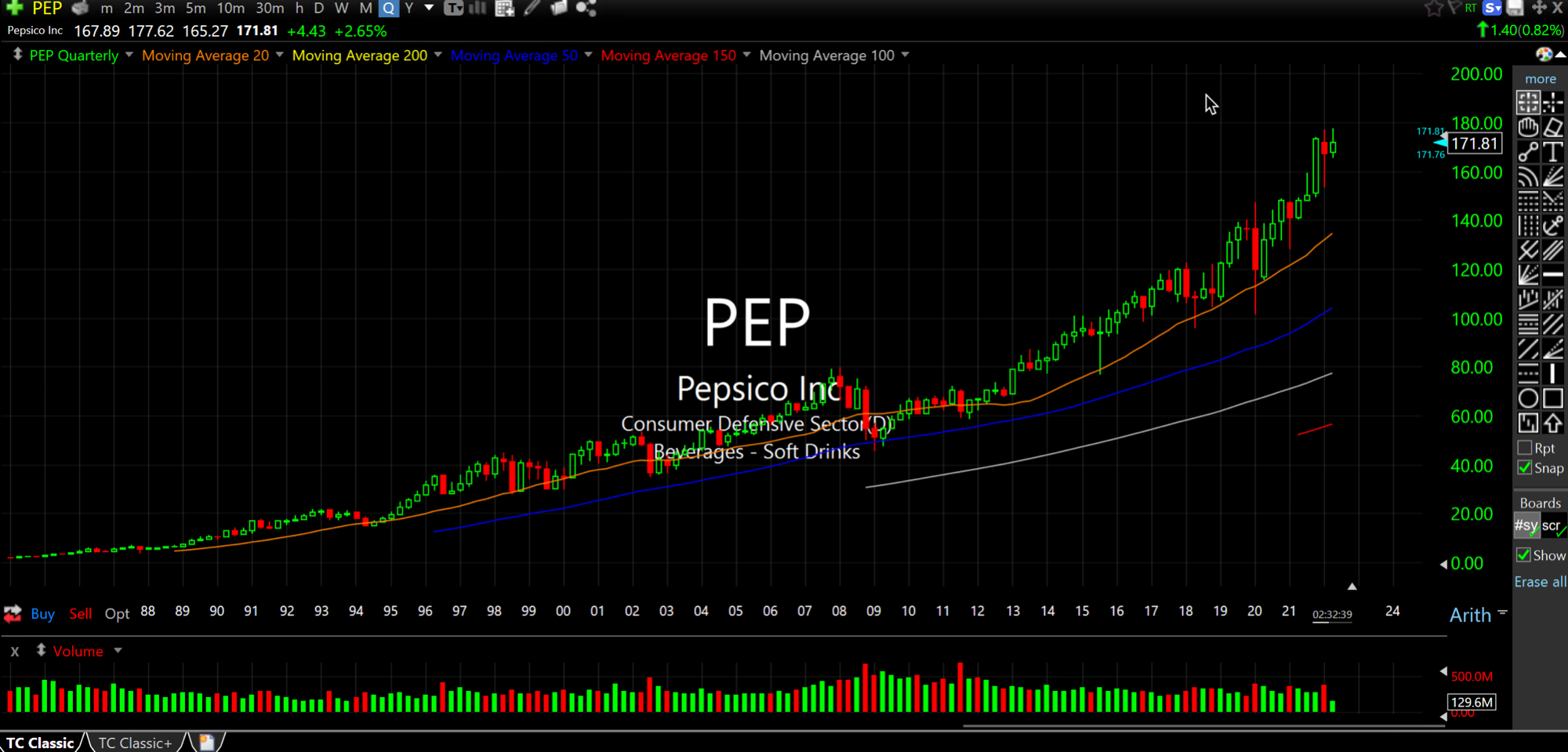

With a Price/Earnings-to-Growth Ratio now over 3 (anything over 1 tends to turn off value investors), a forward PE in the 20s, and a multi-year chart which is as steep as the quarterly PEP seen below, you would be hard-pressed to make a sound case right now that Pepsico represents compelling value.

Instead, the more likely bull case is that there is a Pavlovian response to markets in turmoil, whereby market players rush into "safe" boring stocks for comfort of a modest dividend and reliable cash flow.

While I certainly agree that PEP has reliable sales, is an iconic brand, and is rather boring, I would argue the stock is actually far more dangerous here and susceptible to a sharp fall than many bulls would acknowledge.

Beyond the valuation metrics I described above, PEP is actually housed in the QQQ ETF (!), which is for the top-100 stocks in the Nasdaq Composite Index. That seems to be an overlooked market tidbit, except that when we see dicey conditions like we are now it raises the specter of forced liquidations.

Specifically, barring a major and imminent stock market bottom, the tech monsters could easily become sources of liquidity for market players who need to sell to meet other obligations. And with PEP in the QQQ, it becomes uniquely vulnerable to getting swept up in that mess.

Oh, and by the way, because it is no longer cheap and is arguably way overvalued for a defensive name you are not likely to see astute value players step back into it so quickly.