19May3:40 pmEST

They're Trying to Mask it From You

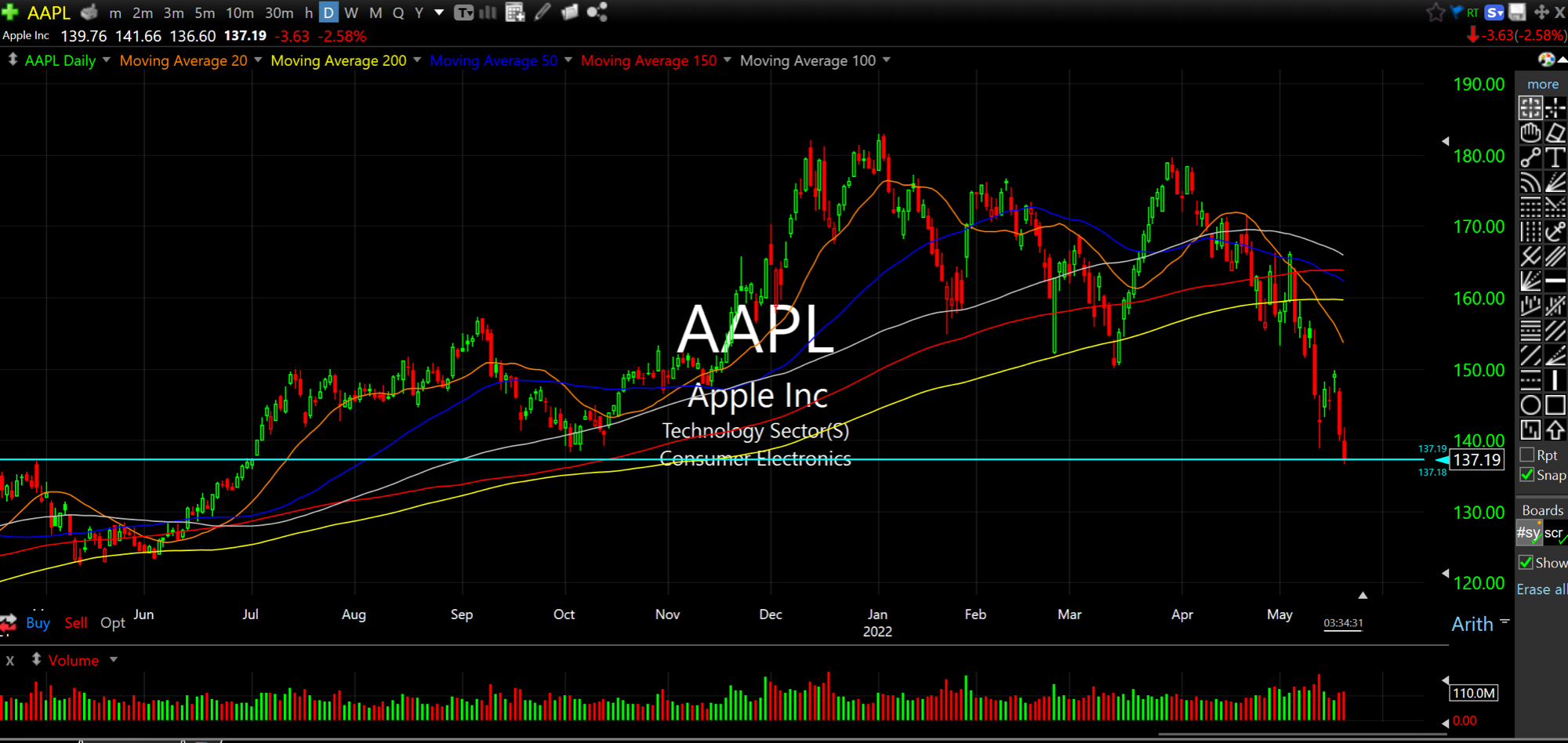

While ARKK and many downtrodden growth stocks catch a bid today we have shares of AAPL (below on daily chart) hitting their lowest levels since July 2021.

With a $2.22 trillion market cap, and the trifecta of ETF component weightings (DIA QQQ, and SPY), Apple is as serious as serious gets for this market. We know Buffett is still in the name, but he has tons of profit cushion plus dividend payouts at this point, which means it is highly unlikely he will sweat even a meaningful pullback from here. I can assure you, using 2008 as an example, following Buffett down in the early-mid phase of a bear market is a trap many retail players fall into--Buffett is Buffett, but even he is fallible in bear markets.

We also have monthly options expiration tomorrow, which is causing many to float theories about the price action today. I normally do not delve much into those theories, but I will give a nod to some possible positioning in the growth stocks. We do have PANW earnings tonight, a fairly significant cybersecurity play in software.

Having said that, there is no way I am going to side with ARKK over AAPL for the time being. If anything, the ARKK/growth bounces seem like the perfect mask for the big money to unload AAPL as they may very well see the writing on the wall for the economy as The Fed is trapped between sticky high inflation and slowing growth.