26May2:36 pmEST

More Than Just Summer Driving Season

It is difficult to overstate just how bullish the price action in crude oil is right now (and gasoline), given the events of the last three months where we have seen Fed tightening, economic data points suggesting we clearly peaked in growth and could easily be headed towards recession by the end of calendar year, as well as the negative wealth effect from the shellacking many growth stocks have taken.

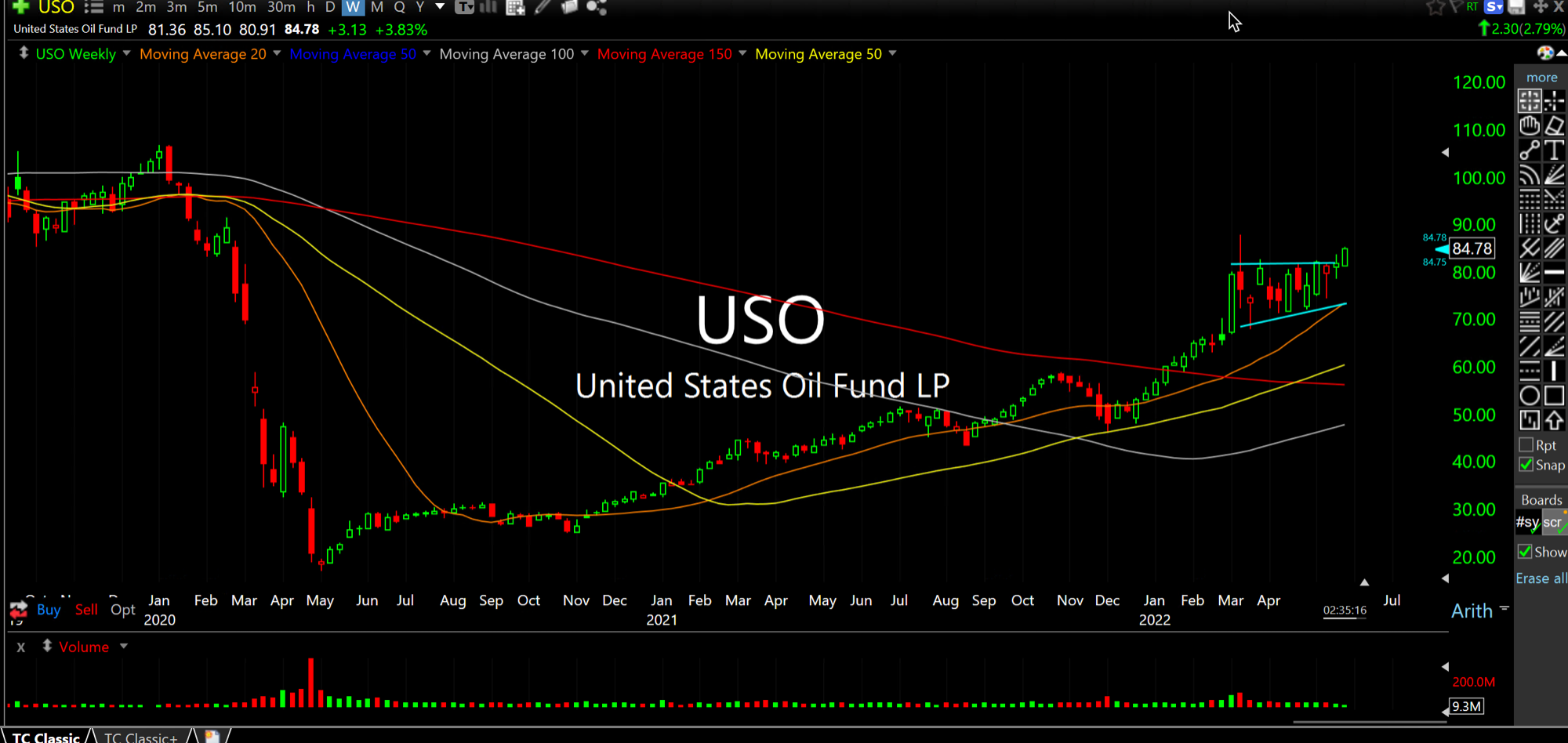

On the USO ETF weekly chart, below, we can see the initial surge in crude into early/mid-March which, ironically, coincided with The Fed's lift off for the rate hiking cycle. That turned out to be a sell-the-news moment, including the Russia/Ukraine war.

But since then, and more importantly, you will note the distinct lack of selling interest. Crude consolidated remarkably well with despite having a multitude of reasons to plummet, if it really wanted to. That did not happen, however, and now both energy and energy stocks are threatening a fresh leg higher into the summer months where seasonal demand for travel is on the rise organically.

However, I suspect there are larger forces at play. As we noted previously, the oil traders have not had to deal with The Fed's endless interventions since the global financial crisis the way the bond vigilantes have. And oil traders still may prove to be the ultimate check on a Fed which remains way behind the inflation curve.

As inflation remains sticky, even slowing economic growth and a tightening Fed may not be enough to squash it due to the supply issues and increasingly embedded psychology amongst the public.

It is rather easy to proclaim that "price is truth," and that, "we are all slaves to the market's price action," but when push comes to shove how many people right now are really, truly behind this move higher in energy and energy stocks?

The answer is not very many...yet.

Bear Market Psychology 05/25... Searching for Pressure Point...