12Jul3:38 pmEST

I'm Sorry I Ruined Your Peak Inflation Party

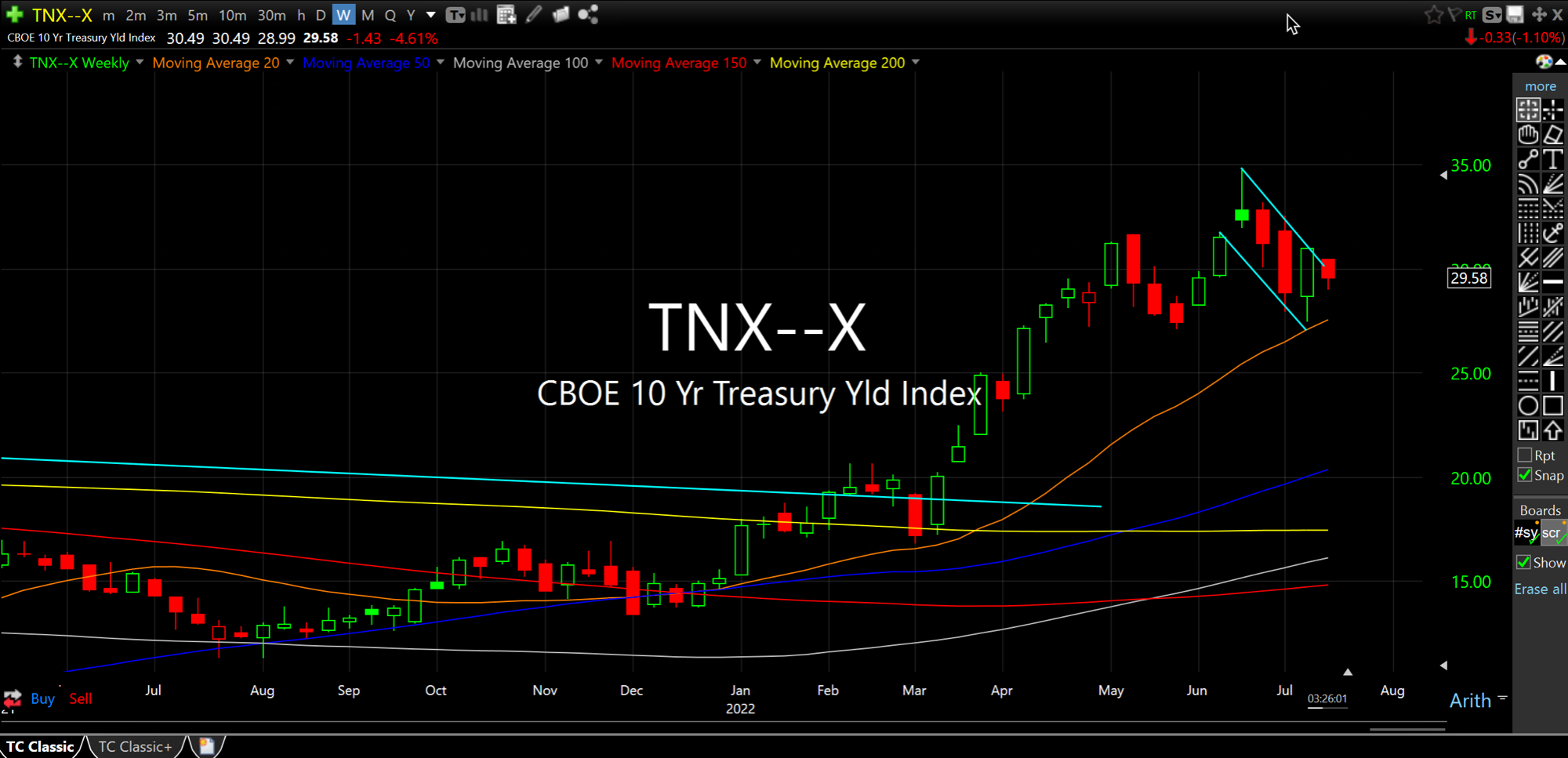

The trend is still up in rates this year, despite how many calls I am seeing for peak inflation already having hit and the inevitability of rates cratering back down.

Thus, headed into a CPI print tomorrow morning where it seems like folks have become far more concerned about a recession than higher rates, I almost feel contrarian in thinking that rates can keep moving higher yet.

On the TNX weekly chart, below, which tracks rates for the 10-Year Note, we can see a tight flagging consolidation this summer so far. I do not see a topping pattern yet, and would give deference to that overall trend of higher rates the last few quarters in this inflationary regime.

It is also worth noting that when we experience prolonged choppy trading conditions, as we have, many market players can become jaded and lose the forest for the trees. In my case, I make a conscious effort to re-focus myself and err on the side of the prevailing trends which, in this case, are still firmly lower for Treasuries (meaning rates higher) and lower for growth stocks, to boot.

Commodities and their stocks have been a mixed bag--Oil stocks dirt cheap now in many cases but not acting well despite being in overall uptrends. I would love to get back involved with them, but need to see better action first.

But the take-home message is that we have been treading very lightly with Members by design. And now that the CPI is upon us with a new earnings season approaching, it would be wholly consistent with Wall Street if surprises were in favor of the prevailing trends.