05Oct3:32 pmEST

Coal Miner's Revenge

In a brutal bout of timing and bad luck, solars and many ESG types of stocks are taking it on the chin today despite the OPEC news/oil pump. Typically, you wold expect the likes of ENPH RUN, etc. to celebrate the oil news since, after all, the higher oil goes the more pressing the matter becomes for alternative sources of energy. But with famed short seller Carson Block making his views on ESG known, those stocks are going the wrong way.

However, for old school energy sources like dirty coal, they are moving with oil nicely today.

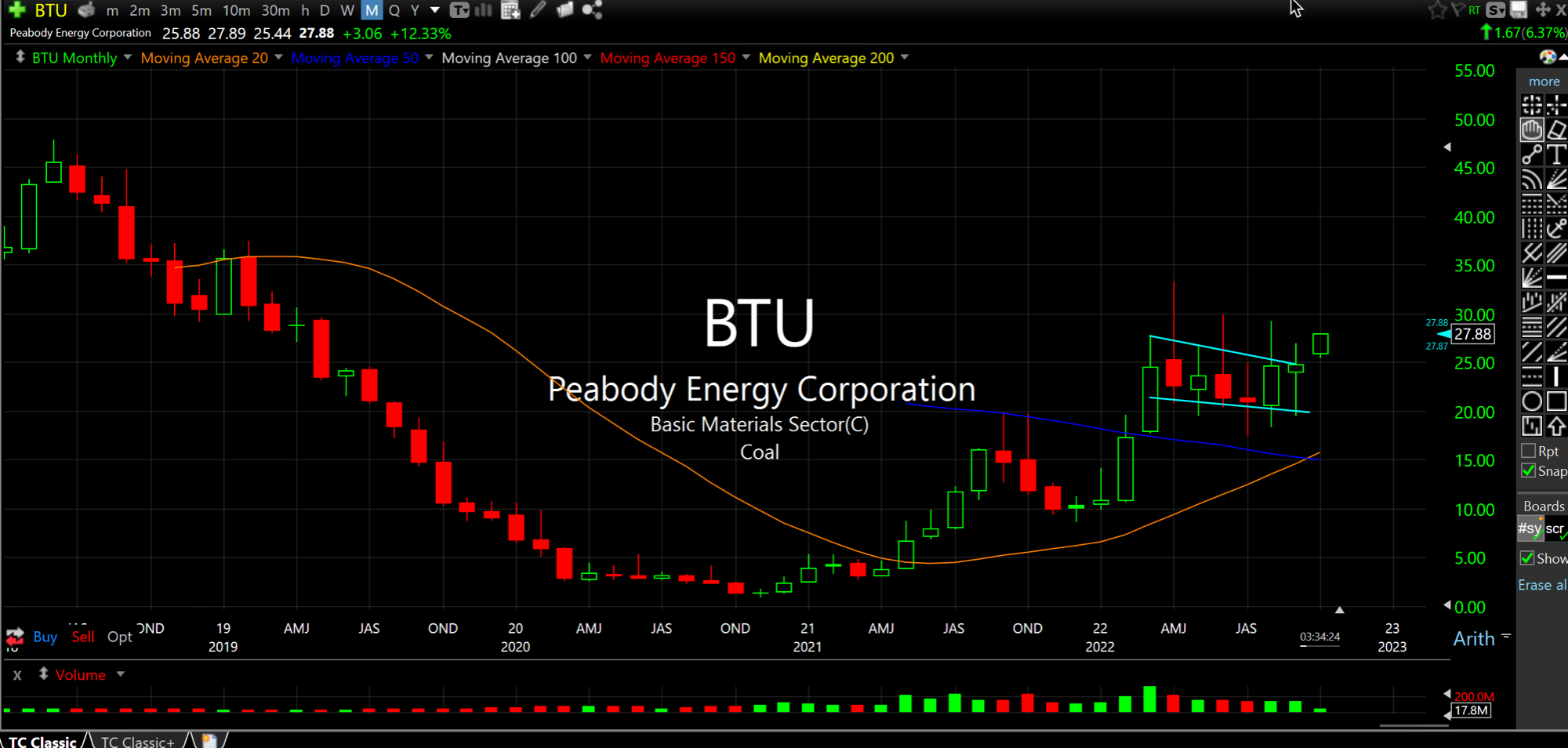

Beyond that, as you can see on the BTU monthly chart, below, the bull flag is not just for Peabody Coal but also peers like ARCH ARLP CEIX, among others.

I suspect that uranium and coal should be front and center should the oil move have legs into the heart of autumn. Many seem to be either frozen still on this OPEC news or actively doubting the move.

But after a sharp summer correction I suspect those who wanted to sell their oil by now most certainly did. And as long as rates and the Dollar level off just a bit it should be game on for a commodity leg higher.