22Nov11:28 amEST

Price is What You Pay; Value is What You Get

As a protracted bear market continues to unfold you will eventually see the pundits on financial news television pivot (wink, wink) from steadfast bullish predictions into blasting markets for being irrational and thus creating compelling "values" across the board.

Let us take two recent earnings reporters this week as example.

Zoom Video, first below on the monthly timeframe, was one of the poster children for pandemic era winning stocks, coupled with a backdrop of wildly bullish sentiment and tailwinds for tech growth in general. The stock is down about 6% this morning after earnings despite already having cratered from $588.84 to a recent low of $70.43.

ZM is certainly less expensive that it was in 2021. But that does not make it a value case, per se, especially with new secular themes underway which now represent headwinds, not tailwinds, for most tech growth stocks. In other words, I do not view ZM as a value play and likely will not be doing so for quite some time.

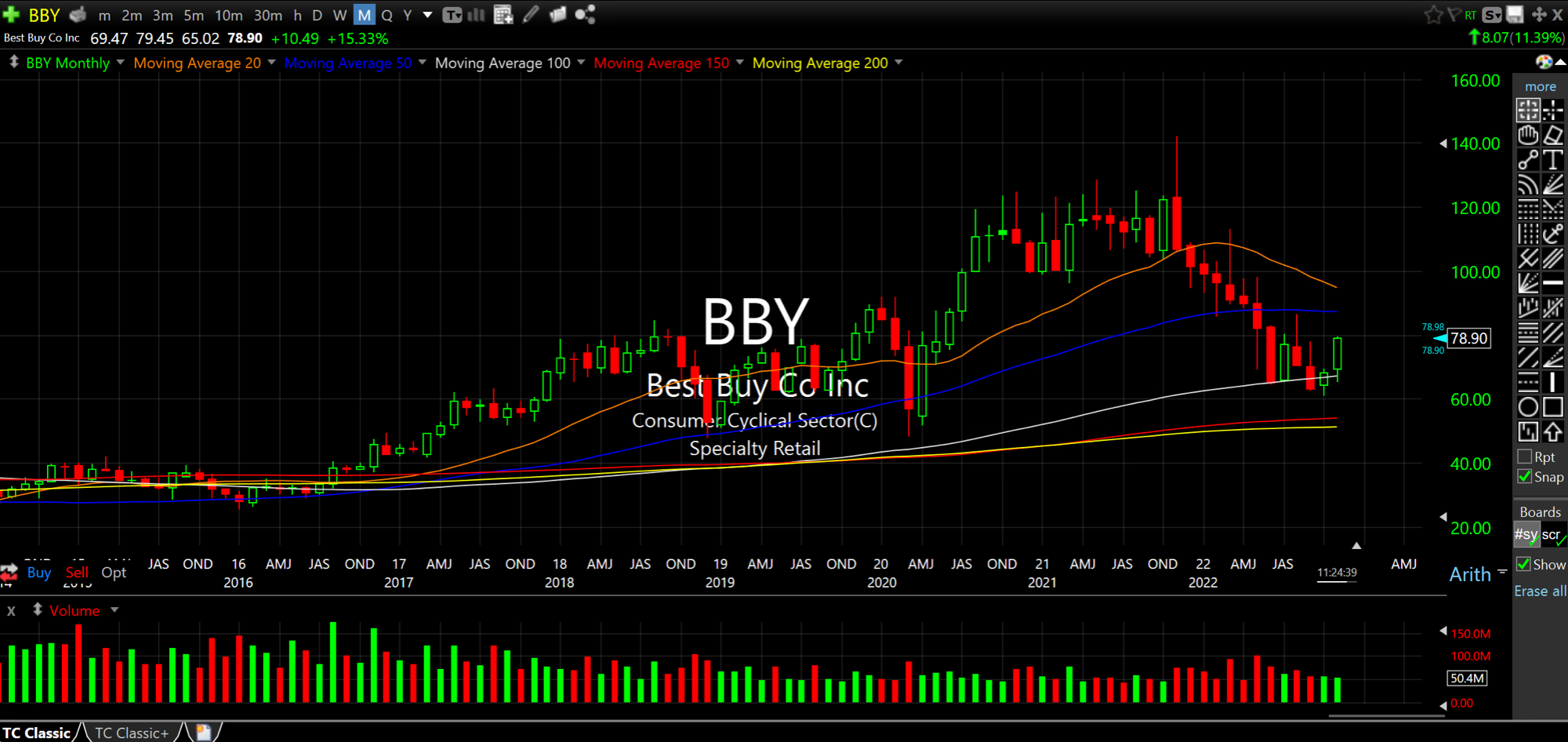

Best Buy, however, the second monthly chart, below, is absolutely a legitimate value and has been cheap (talking about PE ratios) for quite some time. Among big box stores, BBY is arguably one of the better firms in the group and has made sound adjustments over the years with its business model.

The market is acting like it recognizes value after earnings today, with the stock up 11%.

Again, these are just two examples. But as general rule the true values going forward given the secular shift underway with inflation will be favoring commodity and commodity-related plays, consumer staples/utilities, and select well run retail businesses which are trading at cheap valuations. Yes, some insurers and banks may fit in there, too, as well as some healthcare plays.

You will note the sheer lack of glamor or sexiness on that list, however--Get used to it, as this is a long overdue reality check for markets. Do not conflate falling prices with rising value, in a vacuum.