23Jan11:37 amEST

On a Collision Course

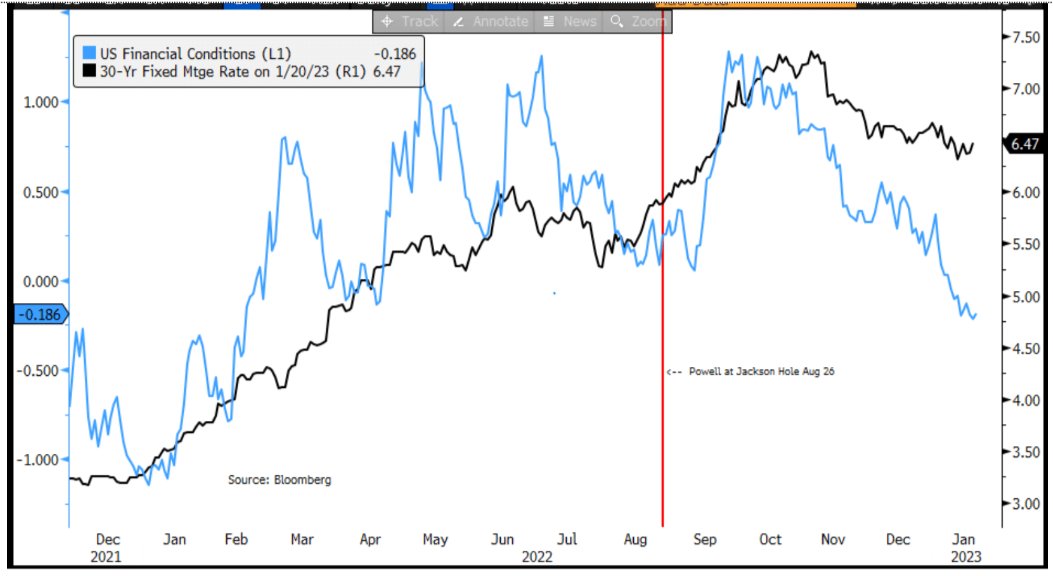

Courtesy of @WallStJesus, the chart below shows financial conditions easing considerably in recent months. And that goes double since the start of 2023.

The market is clearly not interested in thinking too far ahead beyond trying to price in the bold assumption that The Fed will not only pause their rates hike soon but actually start easing in due time.

However, as we have been discussing with Members the issue there is that markets are, ironically, undermining their own efforts since the actual easing of financial conditions by markets makes The Fed's jobs all the more difficult of claiming victory against inflation.

In other words, inflation is already on the comeback trail and The Fed is in the untenable position (through no fault of their own) of needing to stay higher for longer with rates, certainly much higher and for much longer than markets are currently expecting.

So while the rally is a feel-good moment for bulls and the soft landing/new bull market crowd, not much has changed on my end as far as the long-term risk/reward ratio of about 100-200 points of upside on the S&P 500 Index, max, versus 800-1200 points to the downside once reality sets in and stocks get repriced aggressively lower.

Earnings this week, such as MSFT TSLA, could easily be the first shot across the bow in this regard. But I am more focused on the FOMC next week and how Powell handles the situation with quite a few notable doves at The Fed clearly trying to pressure him back down sooner than he probably wants to.

Weekend Overview and Analysi... This Market is a Real Glitch...