15Mar9:38 amEST

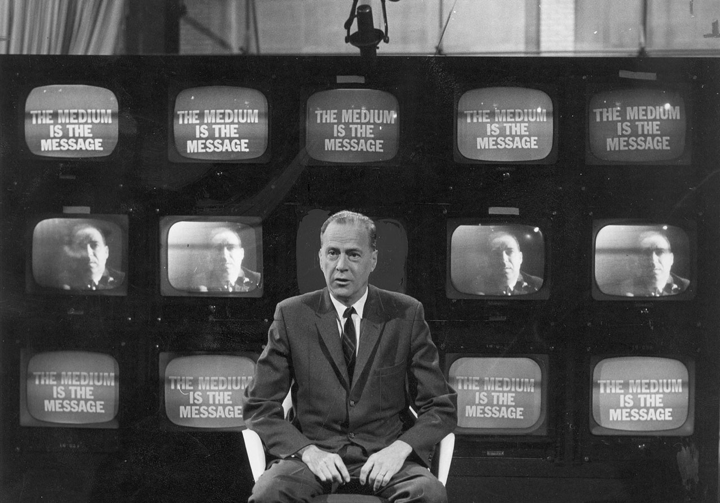

The Medium is the Message

The prophetic Canadian philosopher Marshall McLuhan's famous phrase, “The medium is the message,” suggests that the medium through which we choose to communicate holds as much, if not more, value than the message itself.

Considering McLuhan died the same year as I was born (1980), he was way ahead of his time with his foresight about the world wide web, for example.

But the above phrase is what he became famous for, and it sure seems applicable to modern day markets in various aspects.

Specifically, applied to the current tape we have tons of violent, seemingly random price swings outside the realm of normal ebb and flow, backing and filling. This holds true for futures and cash markets alike.

And after yesterday afternoon's ramp into the closing bell we are now gapping down on the S&P 500 below yesterday's lows as the global European giant bank, Credit Suisse, is clearly in trouble down by nearly 24% as I write this--Other banks are down across the board, too, both in the KRE and XLF ETFs. Also note another European giant bank, Deutsche Bank (DB) down 9% too.

But the main takeaway for us and with Members as we have noted is that the violent indecision, itself, is the message. It is not about cherry-picking a given upswing or downswing to fit your bias, but instead extracting the message of wild indecision by the market as to how to properly price assets given the uncertainty about which banks are in grave danger imminently, what rates will do as per The Fed, and a relatively expensive equities market after more than a decade of an ultra easy Fed.

History says this resolves lower with force, and the violent price swings are the reddest of flags.

Stocks Up, Rates Up, Playing... We Didn't Go to Stock Market...