02Jun10:26 amEST

The Pause That Wouldn't Refresh Anything

A strong jobs report for May is sending the Dow and a bunch of sectors which have been lagging higher with rates and the Dollar. Meanwhile, tech, biotech, ARKK, and chips are mostly red as bulls continue to look for a "pause" in the rate hikes from The Fed later this month at the June 14th FOMC. Bulls also argue, alternatively, that even if there is no pause, then who cares since the economy is obviously so strong it can take more hikes.

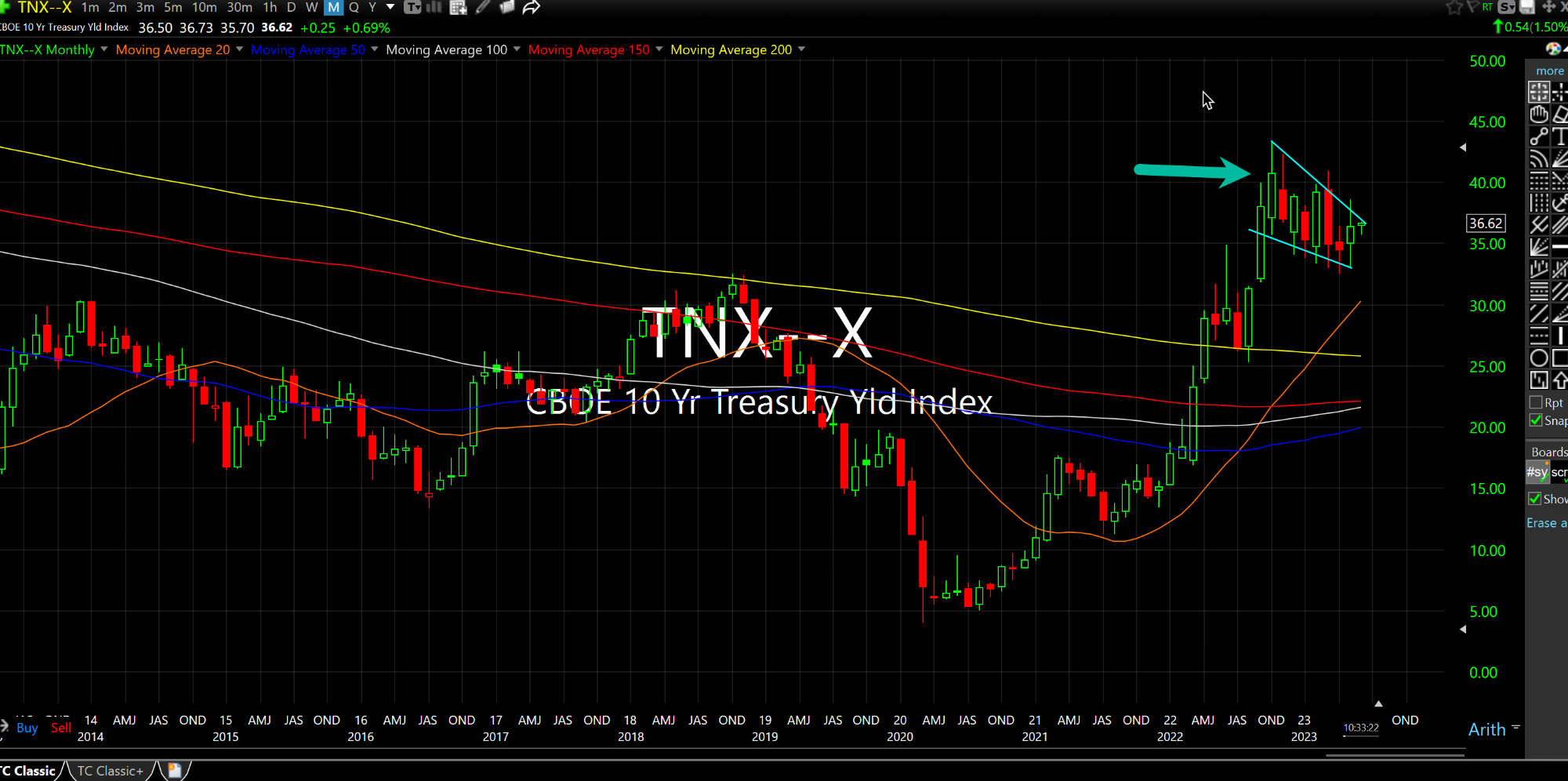

But with rates back on the move higher on the 10-Year Note, I still maintain the biggest pain trade is still a fresh breakout higher in rates which forces various financial models to recalibrate risk and valuation for many tech/growth stocks which remain both crowded and overvalued.

One thing is for sure: If the monthly chart bull flag on the TNX (Index for rates on the 10-Year Note, below) resolves higher, The Fed pausing its rate hikes will do anything but "refresh" this inflation cycle.

It's Only Degeneracy When Ch... Weekend Overview and Analysi...