21Jul2:09 pmEST

This Sentiment is No Joke

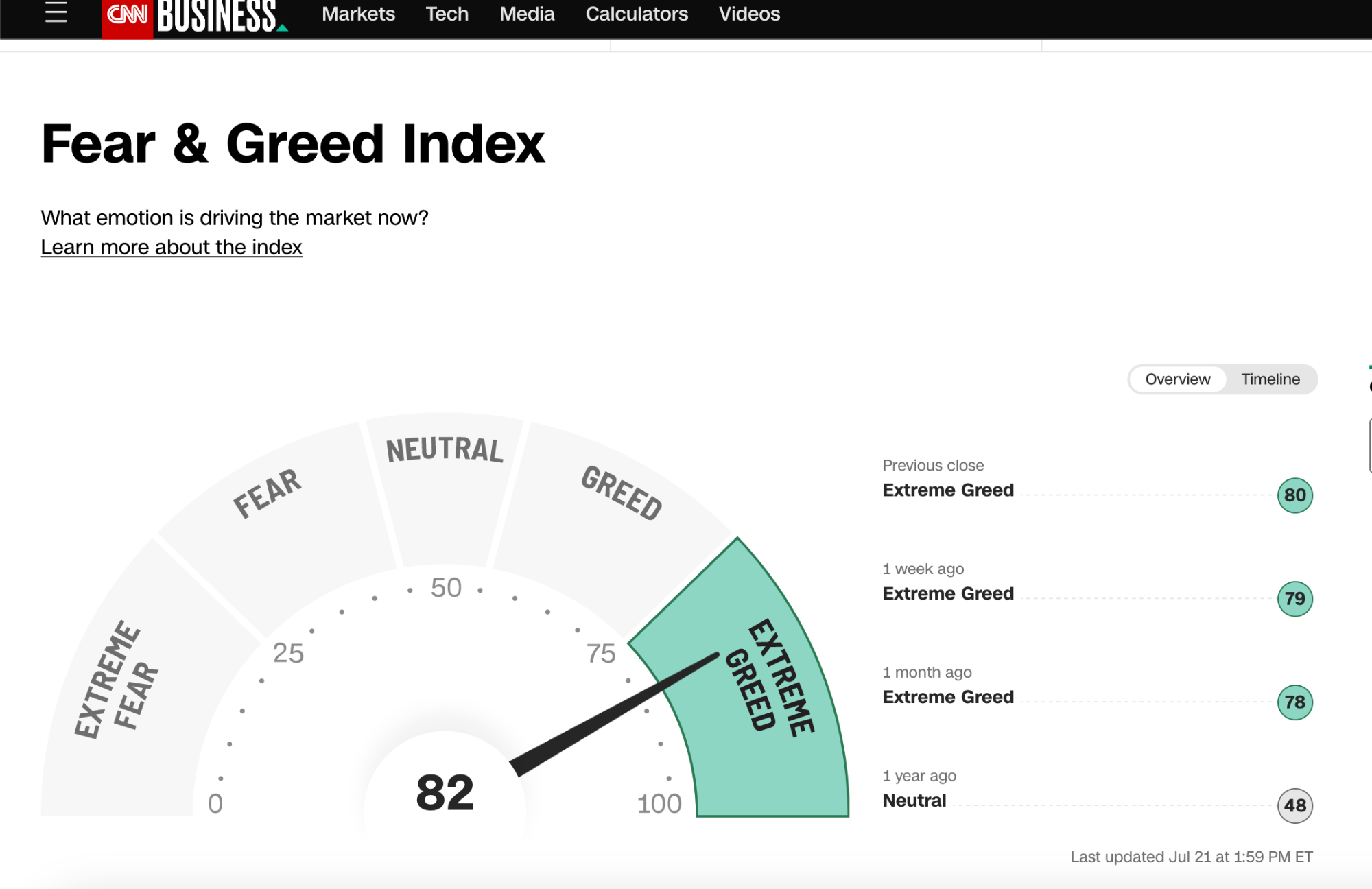

CNN Fear & Greed Index's (below, updated) rigorous methodology has pointed to stubborn "Extreme Greed" for over a month now with only very brief slippage down to "Greed" territory. For as long as I have been tracking this Index, this is easily one of the longest streaks in either extreme territory that I have seen.

But of course that is not much of a surprise at this point as bulls feel their oats and dismiss any notion of a top as "bear porn," or the like.

Today's monthly options expirations builds up to as busy a week as you will see in the middle of summer: We have the FOMC, plus the Bank of Japan and ECB rate decisions. Then we have a plethora of mega earnings like GOOGL META MSFT, among many others.

The speculative fervor continues, with DWAC the meme stock du jour, up a cool 50% as I write this, as CVNA cools off after its recent run.

I will have plenty over the weekend to say to prep Members for the FOMC next week. However, just know that even with a rate hike basically baked in, Powell hinting at future rate hikes in a convincing way may very well upset the market.

When sentiment and mega cap leaders are this extended for this long, all it typically takes is a quick slip on the banana peel to shift the tone and tenor of the market, and eventually the trend. With gasoline prices on the rise I have a hard time seeing how any Fed, including this meek one, can even hint at rate cuts anytime soon.

So the issue is still imminent future hikes, factoring in gasoline prices and the base effect of year over year inflation resetting with the next CPI, I still adamantly believe inflationary surprises will be to the upside.

It's Not Just Netflix and Te... Weekend Overview and Analysi...