10Aug1:24 pmEST

Summer Always Turns Into Hurricane Season

We live in a lower trust society nowadays, and perhaps that means a lower trust market, too. In fact, I am quite sure that is the case, where every bit of data, such as this morning's CPI print, and every market machination is met with a skeptical eye of conspiracy by a not-insignificant group of market players and pundits.

Such is life, however, which means we must continue to roll with the punches.

Core CPI still points to entrenched, sticky high inflation. Thus, my ongoing view of The Fed not cutting rates anytime soon unless we get an outright crash, first, remains intact.

And now we have a glaring fade off the initial gap higher in equities as I write this, with the S&P 500 and Nasdaq suddenly back down around the lows from earlier this week.

With a good six-to-seven weeks until the next FOMC, Jackson Hole at the end of this month looms. But markets are still struggling which Fedhead and pundit to believe insofar as whether there will be another rate hike(s) this autumn into the end of 2023.

One thing is for sure, though, just as sure as summer always turns into hurricane season, periods of melt-ups and exuberance in markets almost always turn into rougher seas.

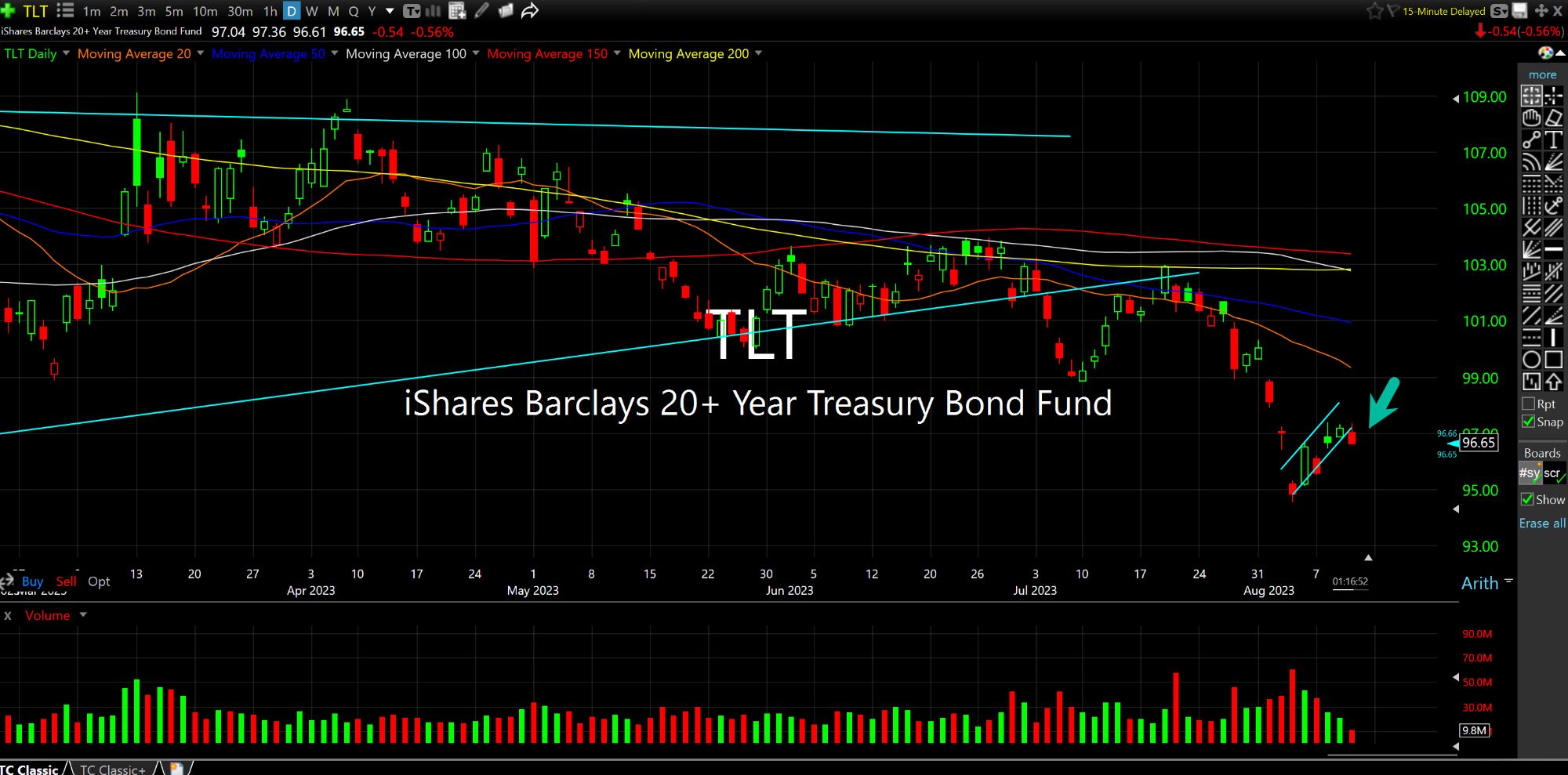

Finally, note the bear flag looks on TLT, ETF for Treasuries, on the daily chart, below. The sheer amount of cheerleading into the recent bounce smacks of still way-too-bullish sentiment on bonds. I expect much lower prices ahead, and thus higher rates as this morning's CPI print, when the dust settles, only reinforces higher for longer and not a victory against inflation.

I Wasn't Joking About the So... I Feel Sorry for Your Thesis...