13Sep10:33 amEST

Know When You're Being Manipulated

You may have noticed the language coming out of people like Nick Timiraos (of the WSJ and widely seen as The Fed's mouthpiece) immediately after the hotter-than-expected CPI print this morning. Specifically, the great lengths he went to downplay the uptick in inflation. He noted how it was merely "a touch" above expectations, as though he were orchestrating a recipe on a cooking show, and not likely enough to prevent The Fed rom pausing next week at the FOMC.

Meanwhile, whenever we got cool prints he was head over heels jumping for joy at The Fed's apparent inflation victory. Of course, I could use Yellen and other folks, too, including Fed heads themselves as examples, but Timiraos illustrates the clear narrative being sold to you on a daily basis.

Simply put, the people inside the Beltway are hellbent on talking inflation down, even when it goes up!

And, yet, we have oil and gasoline still flagging near recent highs, rates too.

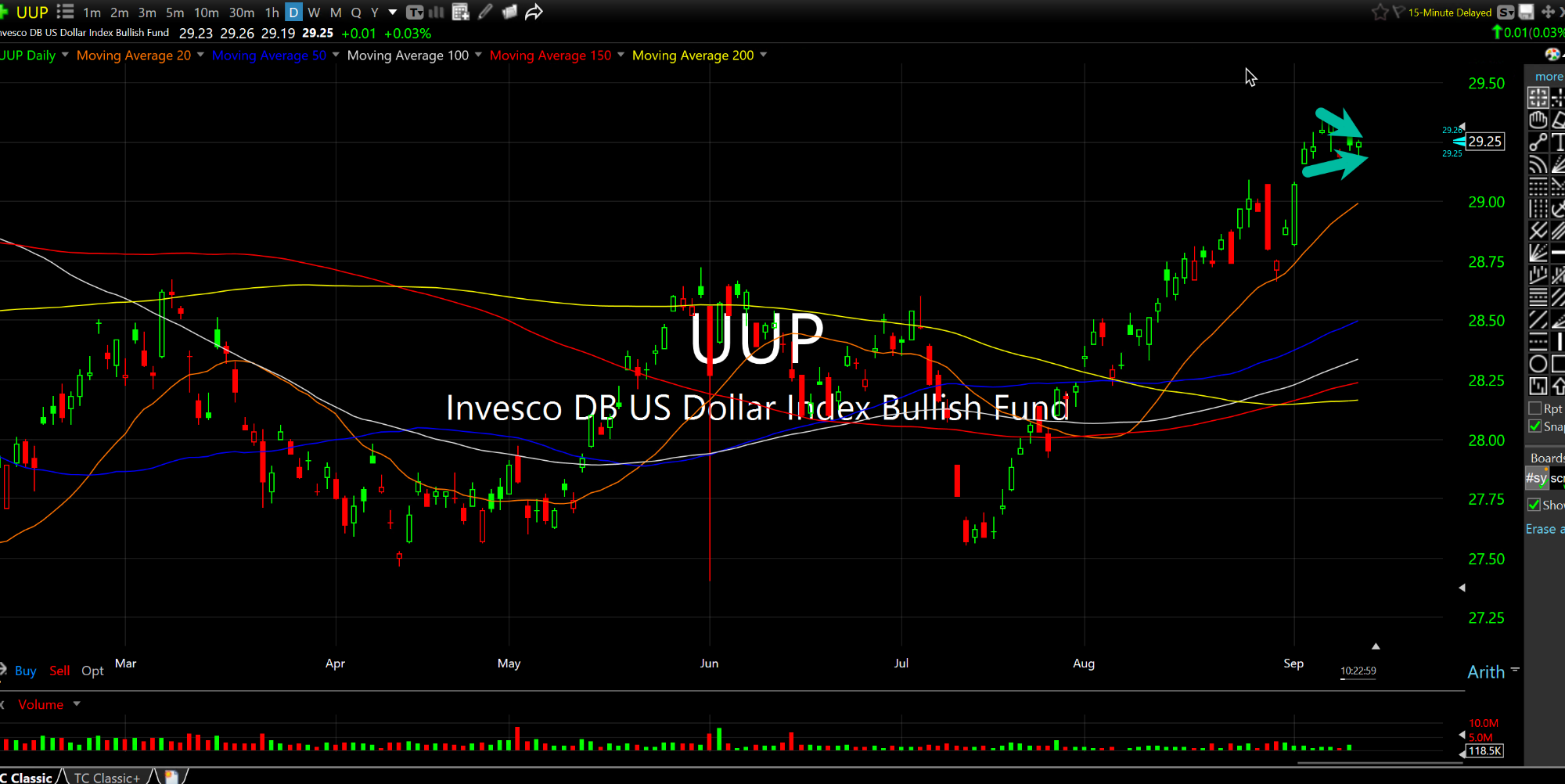

And the U.S. Dollar, below on its daily chart ETF, showing no resistance yet despite the sharp recent rally.

The powers that be are gambling that rates, the Dollar, energy, other commodities like orange juice and sugar, will simply exhaust themselves soon to the upside.

But with such meek monetary responses by The Fed and its cohorts like Timiraos, the pain trade still may be higher yet for those asset classes.

The 10-Year heading up to 5% this autumn is increasingly looking like the path of least resistance, because when it comes to our leadership and inflation, there, sadly, really is no resistance.

Let's Find the Real Apex Pre... Europe Needs a New Marshall ...