27Sep10:45 amEST

Look Who's Gapping Up with Oil

On the second daily chart, below, for the USO (ETF for crude oil), we see the recent tight bull flag that we highlighted with Members resolving sharply higher this morning.

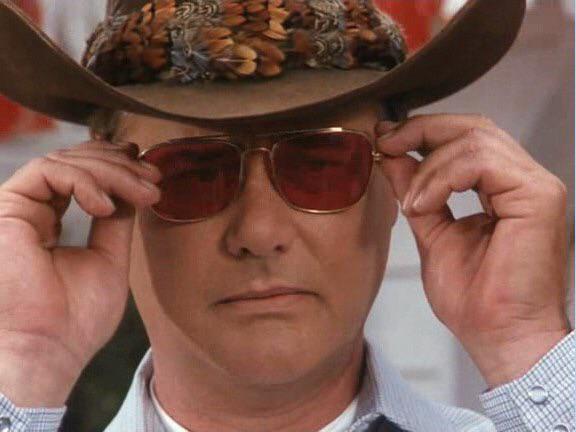

In addition, on the first daily chart we have the gasoline futures ETF, UGA, finding buyers on its recent dip.

Recall that, seasonally, we are well beyond the peak of summer driving season. Logically, we should start to see gasoline prices fall or at least stabilize as demand recedes into the cooler weather.

However, given the dynamics in the oil market that seems to be running counter to seasonality this year. And if both oil and gasoline continue on higher it almost assuredly will wreak havoc on the consumer. The fact that this move in oil is accompanied by a surge in the U.S. Dollar remains problematic on several levels, in addition to rates.

Hence, even with a mixed bounce in equities this morning it is highly suspect the nagging issues facing equities are anywhere close to abating.

In fact, they are objectively growing worse by the day in most cases.

Sunday Matinée at Market Ch... War is Hell But This Market ...