22Apr12:48 pmEST

Shaking the Tree

Equities are kicking off an extremely busy week of earnings and macro news with a relief rally from near-term oversold conditions arrived at after the sharp selloff in the Nasdaq into last Friday. Commodities are mostly getting sold, with the exception of natural gas and some lagging ags like wheat, which probably illustrates the correlations in this market, with gold/silver/oil trading inversely at times to the Nasdaq/growth stocks.

I have already seen quite a few call today a durable bottom in equities, which is interesting to say the least considering all the Nasdaq Composite Index has done is circle back up to its broken lower Bollinger Band. Meanwhile the semiconductors in the SMH ETF are still operating entirely lower their lower Band as we speak.

All of this renders a bottom call in equities to essentially be a call on the parabolic melt-up continuing unabated.

And while that is always a possibility, I believe it is less likely now due to rates remaining sticky high and the recent surge in gold/silver/oil pointing to global markets sniffing out a regime change.

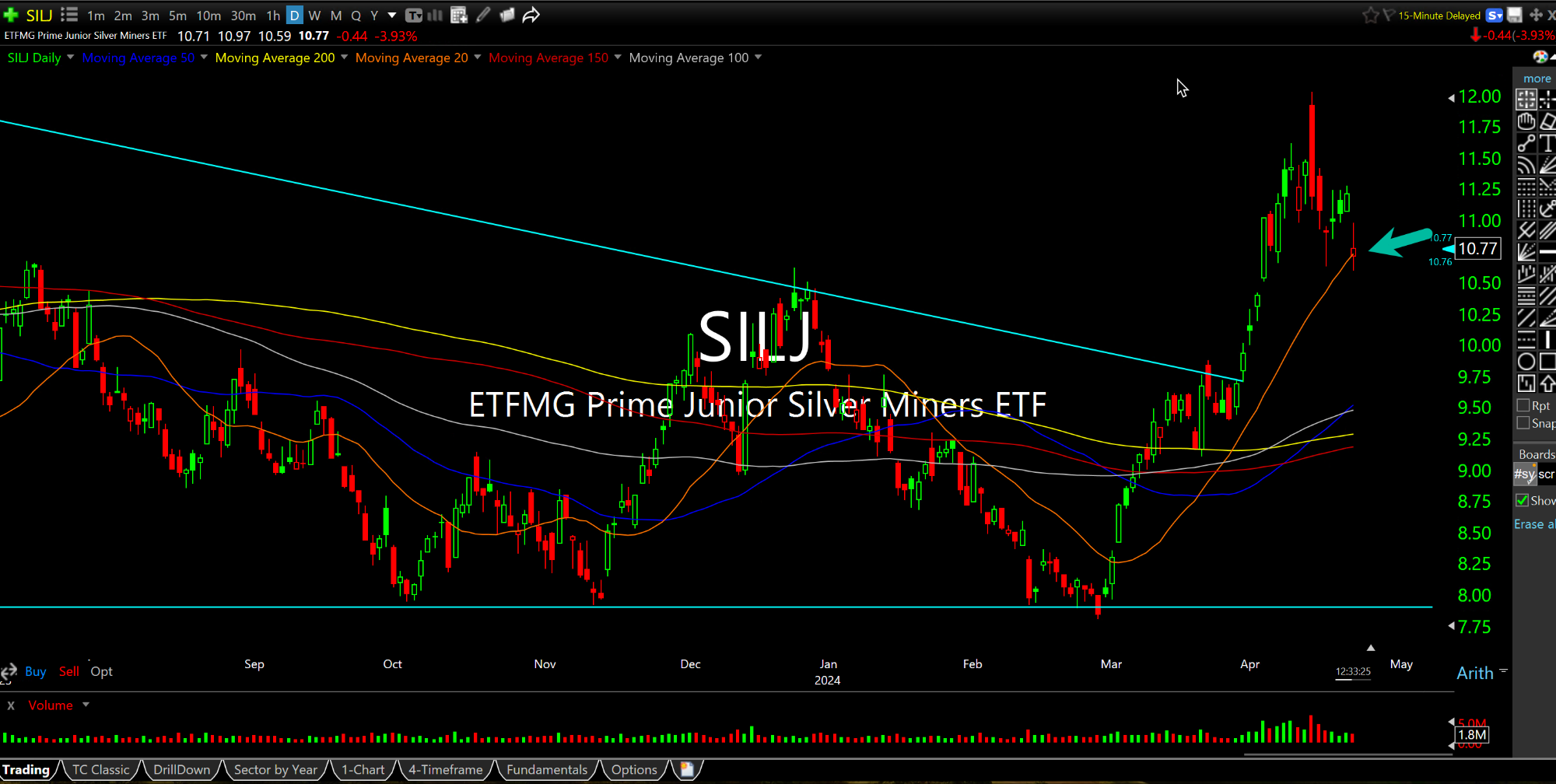

On that note, the silver dip is harsh today and has many calling a top (the same folks calling a bottom in equities).

Silver miners, below on the SILJ ETF for junior caps, are testing their 20-day moving average (arrow) for the first time since the rally began on February 29th. I do not see a top here, but rather a shaking of the tree and am looking for gold/silver bugs to step in and defend these areas this week.

Weekend Overview and Analysi... Maybe He Could Sing But He C...