12Sep12:11 pmEST

Sneaky Pal

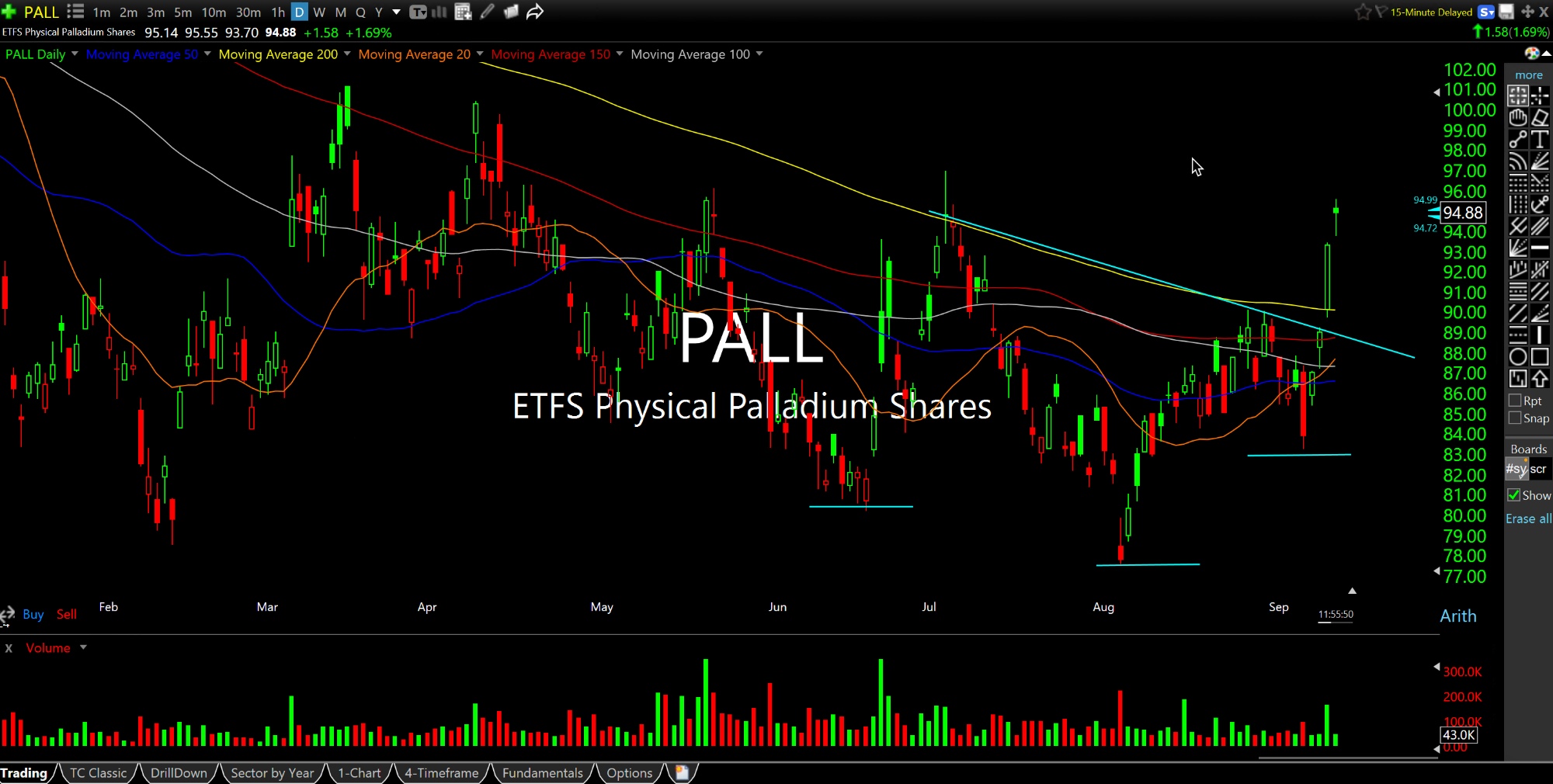

In the wake of gold printing a new high today we have Palladium making a sneaky push higher, too, after a protracted period of poor performance. On PALL, ETF for the Palladium precious metal, below on the updated daily chart, we see the move above the 200-day moving average to confirm an inverse head and shoulders bullish bottom, which took all summer to carve out.

Palladium is, of course, incredibly overlooked even among gold bugs, but it is rather ubiquitous and used in electronics, dentistry, medicine, hydrogen purification, chemical applications, groundwater treatment, and jewelry.

If you believe that The Fed is about to cut rates into a stagflationary environment (where we have slowing economic growth amid nagging inflation which never seems to fully go away), then precious metals likely will be the best performers across all asset classes like in the 1970s.

Hence, paying attention to palladium is instructive. I want to see $90 hold into dips on this ETF going forward.

Elsewhere, the Nasdaq Composite is "kissing" its 50-day moving average today. That 50-day is declining, which has me still thinking the rally is a mere oversold bounce during this bearish season period.

Once Again, the Price Swings... Afternoon Update 09/13/24 {V...