23Sep11:47 amEST

Shorts Don't Want to Land on No Three Mile Island

But I don't want to land in the New York City

I don't want to land in Mexico

I don't want want to land on no Three Mile Island

I don't want to see my skin aglow.

-"Volcano," Jimmy Buffett

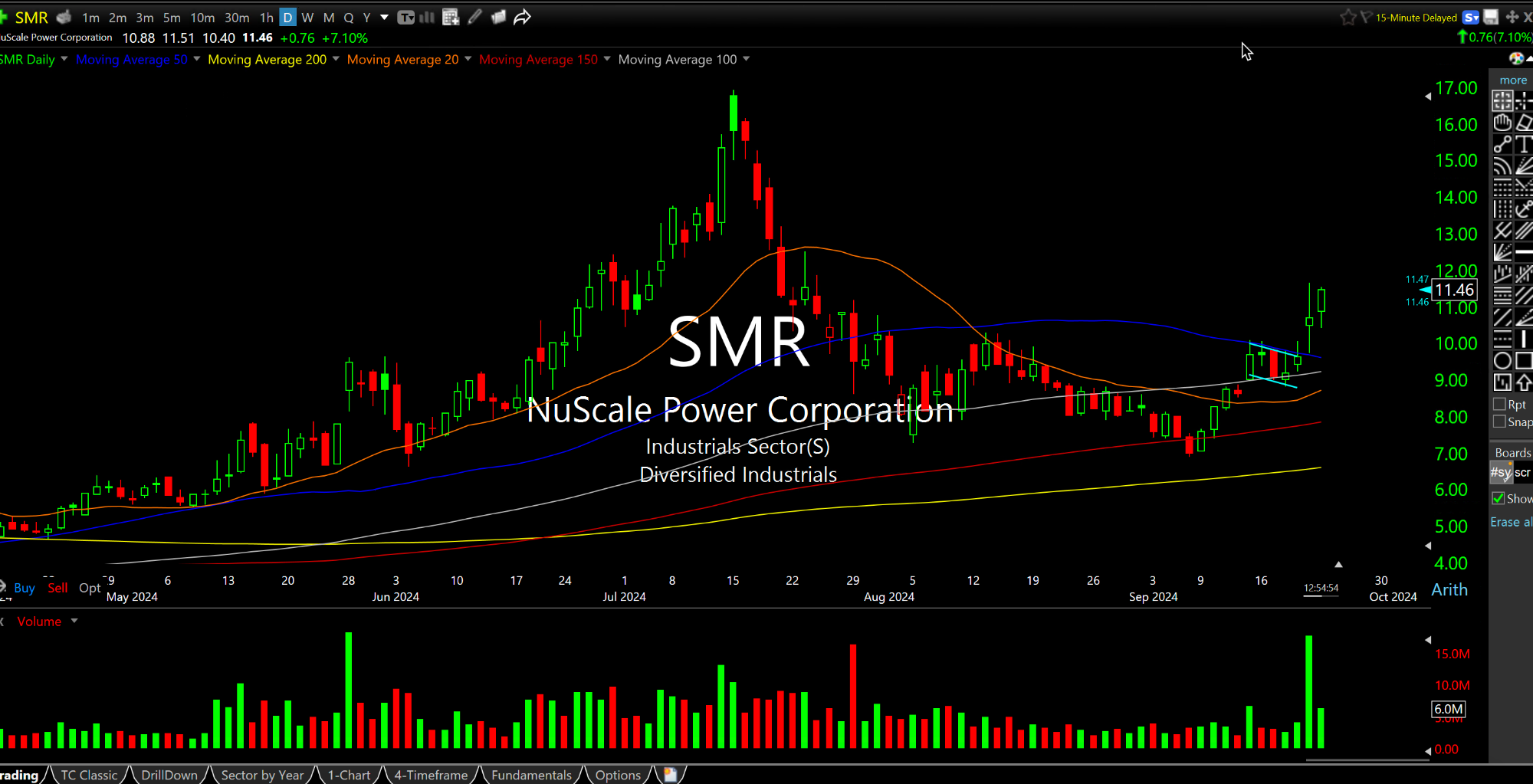

With approximately 25% of its float (the shares outstanding) held short, and a better technical chart than most uranium/nuclear-related plays, NuScale Power, below on the updated daily chart, seems ripe to squeeze higher on the back of the Microsoft/AI/Three Mile Island restart deal headlines.

I went long SMR on Friday afternoon, alerting Members to the idea that the stock is operating above all of its daily chart moving averages and was one of the biggest initial winners off the AI headlines.

Put another way, all of the AI speculative mania is essentially all sizzle and no steak if AI cannot be adequately powered in the coming years, given the extreme valuations for the leaders in the group like NVDA. And that is where SMR comes into play, along with the usual uranium plays housed in the URA ETF.

I see potential to run back to the July highs of $16.91, if not much higher should the short squeeze unfold and the Three Mile Island headlines intensify.

Elsewhere, natural gas is actually seeing follow-through higher for a change, after Friday's big pop. Hurricane season is still in full swing and most traders still want nothing to do with natty.