04Dec3:10 pmEST

Political Trades Require Cunning Instincts

One phenomenon I have noticed over the decades with each incoming Presidential Administration has been the temptation to find the new President trade. With Obama, it was green energy, for example.

But those trades rarely have staying power. In fact, the opposite usually happens, with sectors you expect to lead, lagging, and sectors you expect to lag, leading.

The rationale behind that outcome may very well be the market saying that all politicians are far more bark than bite. Or, perhaps, the trades get priced in rather quickly and then peter out. Or maybe both.

Either way, as I have noted with Members, you can imagine my skepticism when it comes to Trump Trades for his second term (again, I would be saying the exact same thing if Harris had won).

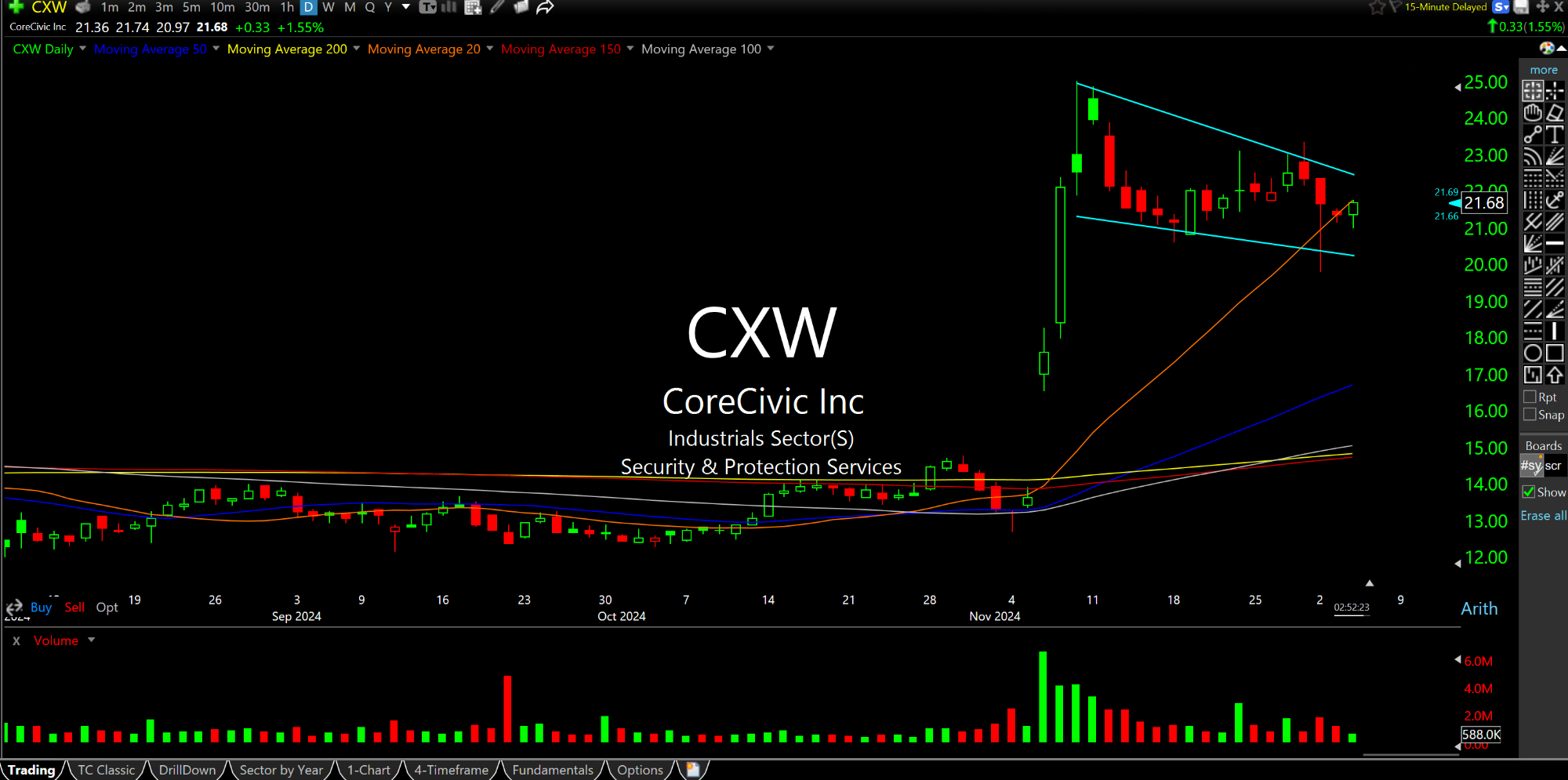

Still, it is hard to argue with how enticing the CXW chart is, below, on the daily timeframe for the private prisons play. We have a tight bull flag after the initial Trump election pop early last month on the theory of more law and order at the border and inside the country.

Simply put, timeframe is critical for these types of trades, even more than usual, since history suggests the bloom tends to come off the rose quite quickly, especially once reality sets in after Inauguration Day.

Seeing the Oil Barrel Half F... Bull Market Don't Die of Old...