14Jan12:49 pmEST

The Danger is No Joke

A cooler PPI print this morning initially ignited a rally in stocks. However, as I write this the rally faded to red, with tech giving up the ghost within the first hour or so of trading. Monsters like META and NVDA are notable laggards.

Further, as we noted with Members in the Morning Prep Video, bonds never really got behind the idea that the PPI print was some strong evidence of inflation abating, especially in front of tomorrow morning's CPI. If the PPI print truly mattered, then bonds would be rallying sharply today with rates getting crushed.

Beyond that, you can really gain insight into the consensus view, as we noted yesterday here, upon the initial rally this morning insofar as folks bragging about how they "nailed" the call that rates were nothing to worry about and that inflation concerns were overstated. The pain trade, indeed, in rates and inflation remains firmly higher.

The reality, as rates on the 10-Year Note recover 4.8% as I write this, is that inflation is still a menace--Simply wishing it goes away remains unfruitful for both bureaucrats and deflationistas/doves alike.

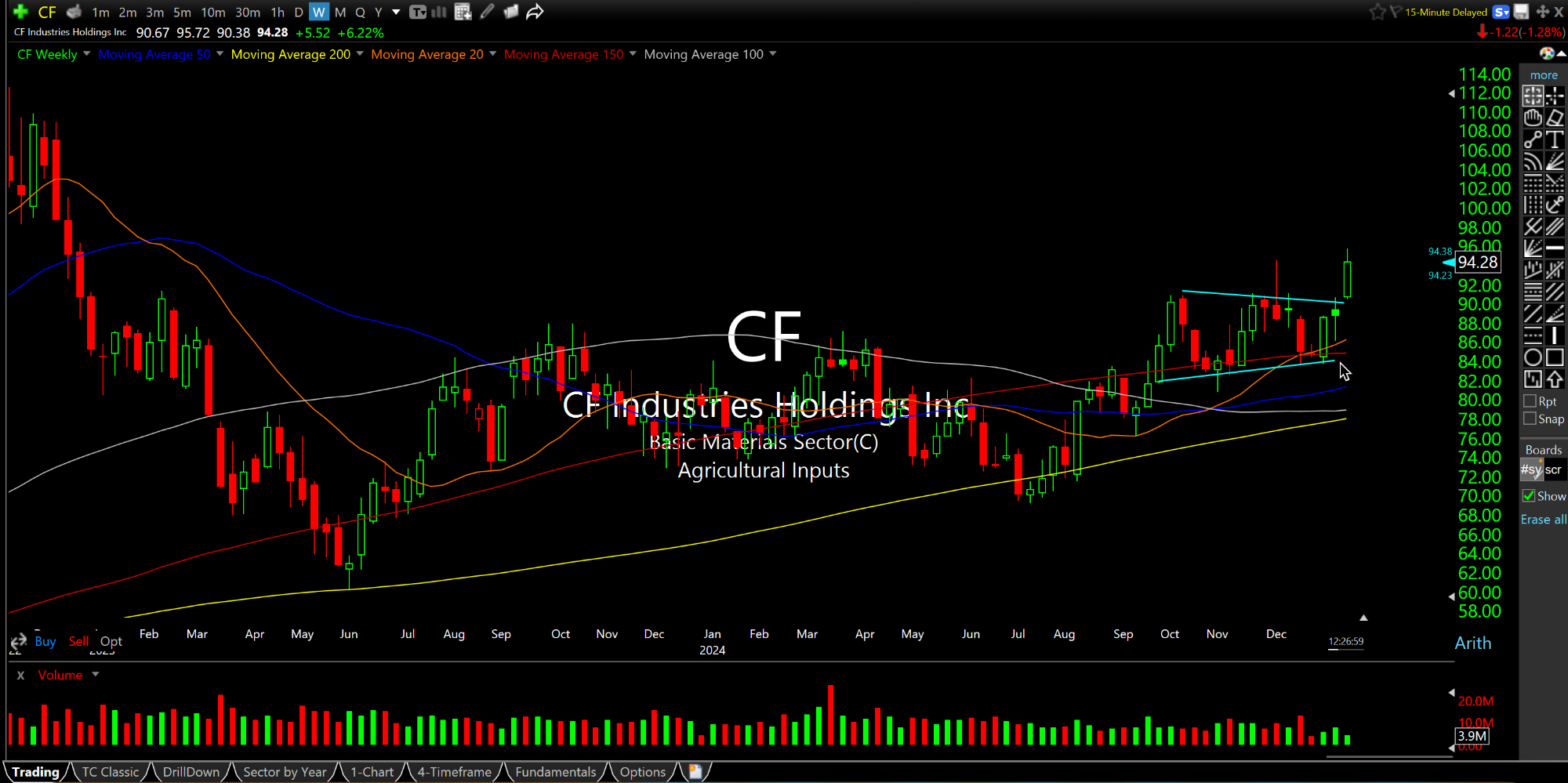

The next danger is that commodities begin to surge one at a time. The ags were an absolute freight train higher during the Q1/Q2 2008 inflation run. And you can see CF, below on the clean and attractive weekly timeframe, breaking to multi-year highs yesterday. CF looks like the ringleader for ags at the moment, well under the radar of most as oil and gold usually occupy the spotlight in commodities.