09Jun2:45 pmEST

Try This for a Thought Experiment

Imagine you find yourself at a cocktail party with traders who mostly began getting involved with markets around the pandemic. Over the course of the evening you make your way around the room and chat up virtually everyone there. To be sure, all of them would be familiar with ubiquitous themes and tickers like AI, NVDA, PLTR, Magnificent 7 names, etc..

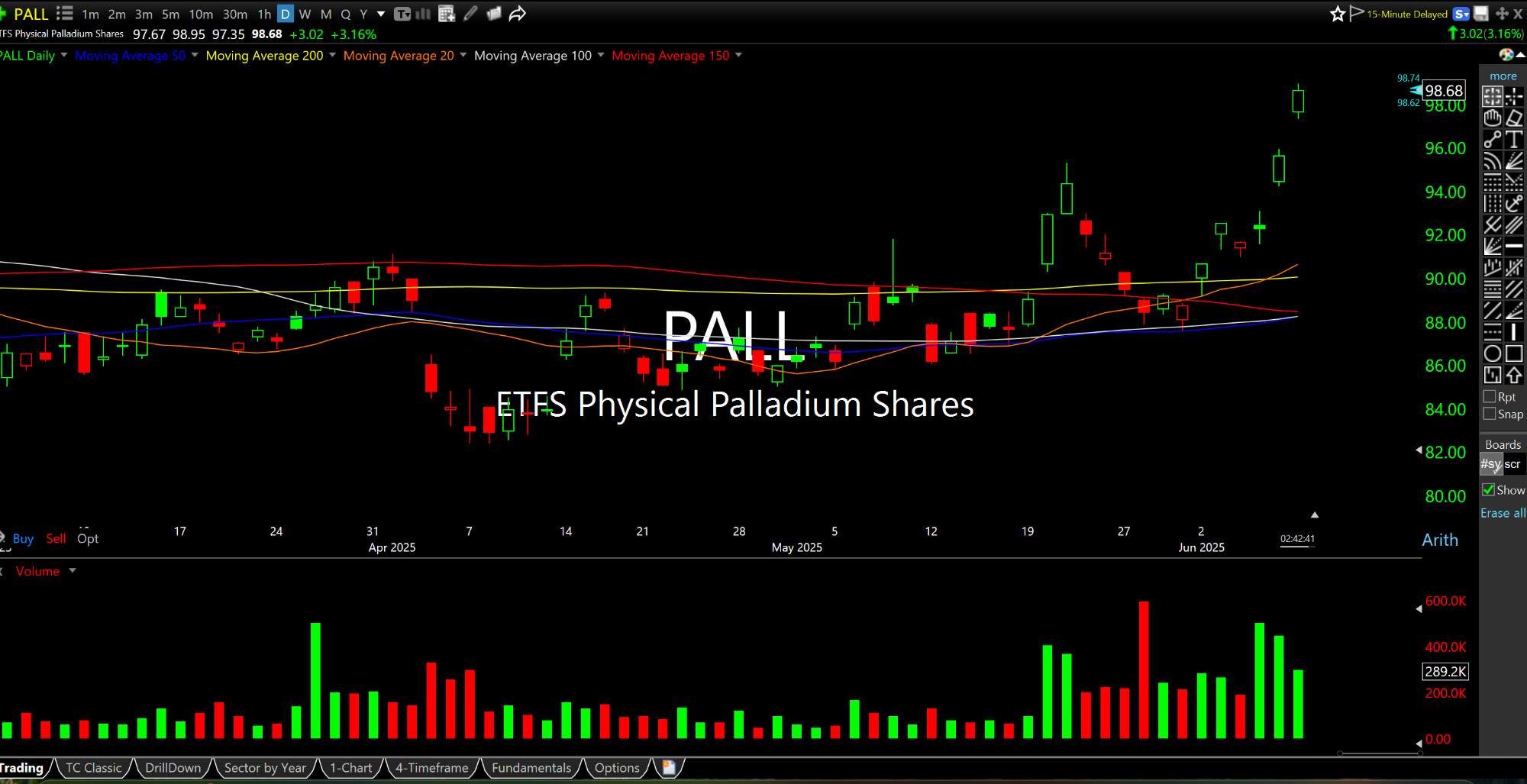

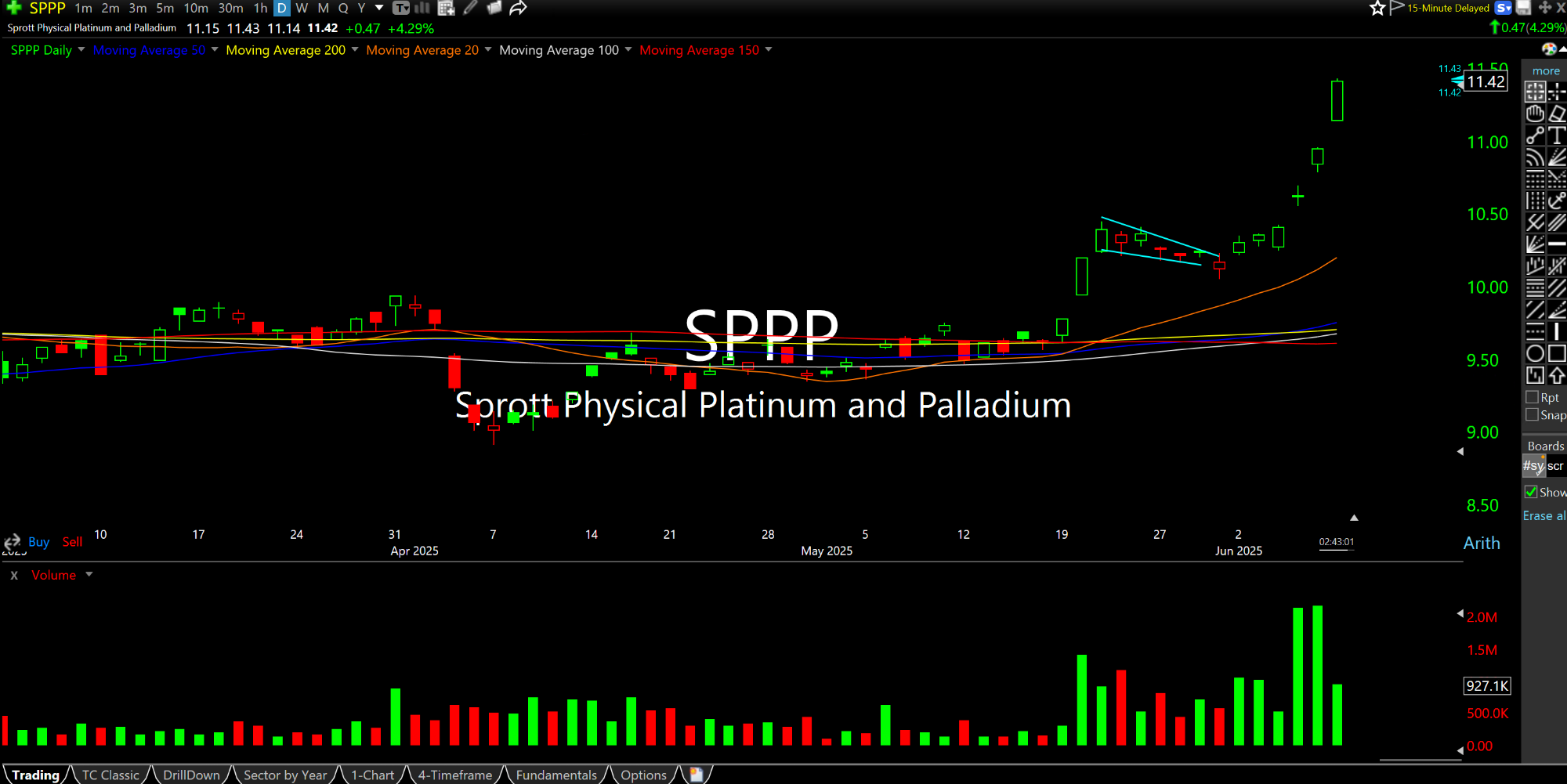

Alternatively, try to objectively estimate what percentage of the people at this event would be familiar with PALL, the Palladium ETF (first daily chart, below), or SPPP (second daily chart).

Frankly, I would be surprised if even twenty percent of the attendees knew of these tickers, let along traded them.

The purpose of this thought experiment is to drive how the significance of the "other" precious metals on heavy buy volume in recent sessions after years of being severely out of favor and all-but-ignored.

Palladium and SPPP (the Sprott Physical Trust for both Palladium and Platinum) are taking the rotation baton while gold pauses. And, of course, silver is surging again after a major breakout late-last week.

Going forward, the initial test, of course, is that breakouts stick. Bulls do not want to see a full retest or breach of the breakout levels in this scenario, since the most bullish scenario is a "lockout" rally which offers no respite for the time being.

But the sheer obscurity of both Platinum and Palladium, coupled with a heavy buy volume price breakout, has me leaning towards them igniting multi-year breakouts as we speak.