24Jun2:44 pmEST

Come and Get Me, Copper

It seems difficult to look through the Iran/Israel ceasefire jubilation in markets this week, with equities squeezing higher while oil gets slammed lower. However, it is worth noting that Fed Chair Powell maintained a (relatively, for him) hawkish stance during the first day of his two-day testimony before the House Committee today. In other words, we are not likely to see any rate cuts this summer.

And that begs the question of whether inflation is about to turn back higher and stun the majority of market players who are convinced it is a thing of the past.

Searching for clues, the estimable Dr. Copper seems to give some insight.

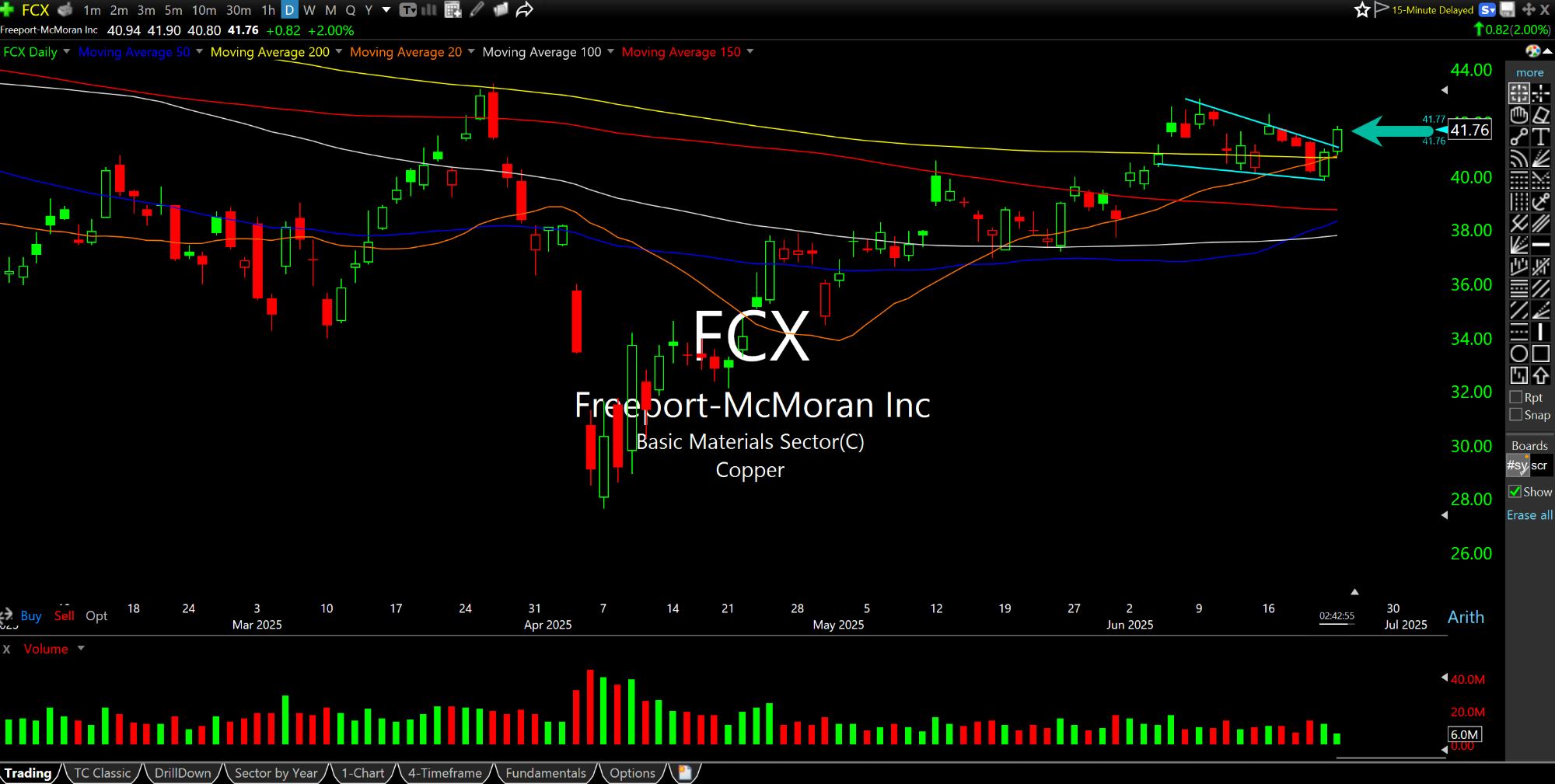

COPP is a thinly-traded ETF for the copper miners worth tracking just as a sector snapshot. But Freeport, below on the daily chart, remains the prominent copper miner of note, with other names like SCCO NAK HBM ERO worth a gander.

Without question, Freeport is unperturbed by the oil selloff today. If this ceasefire were truly a disinflationary event, one would think copper would get crushed in sympathy with crude. Instead, FCX is basing tightly along its 200-day moving average and actually threatening to break higher. Similar comments to the other copper tickers listed above.

Overall, a copper breakout and rotation into copper stocks here would be a sneaky sign that inflation is not going away this summer.