09Jul3:17 pmEST

Not Natural, But Strong

Amazon saw its big summer Prime Day sales down 41%, year over year, in the first day of their four-day event yesterday. In addition, Jeff Bezos just unloaded over $600 million worth of Amazon shares to the open market. And, yet, Amazon is higher today as the likes of META NVDA lead the Nasdaq.

With the Fed Minutes coming in more or less as expected, we continue to see a market hell-bent on shunning any bad news or bad scenarios in favor of the rose-colored outlook. Perhaps it is 0DTE options distorting the action, or the pool or foreign money panicking into U.S. markets, or Trump "insiders" who what is to come, or all of the above.

That said, I am keeping an eye on the semiconductors and Microsoft for signs those extended charts are close to a rug-pull.

In addition, a name like LULU has been acting poorly this week and overall with its bearish chart structure on all timeframes.

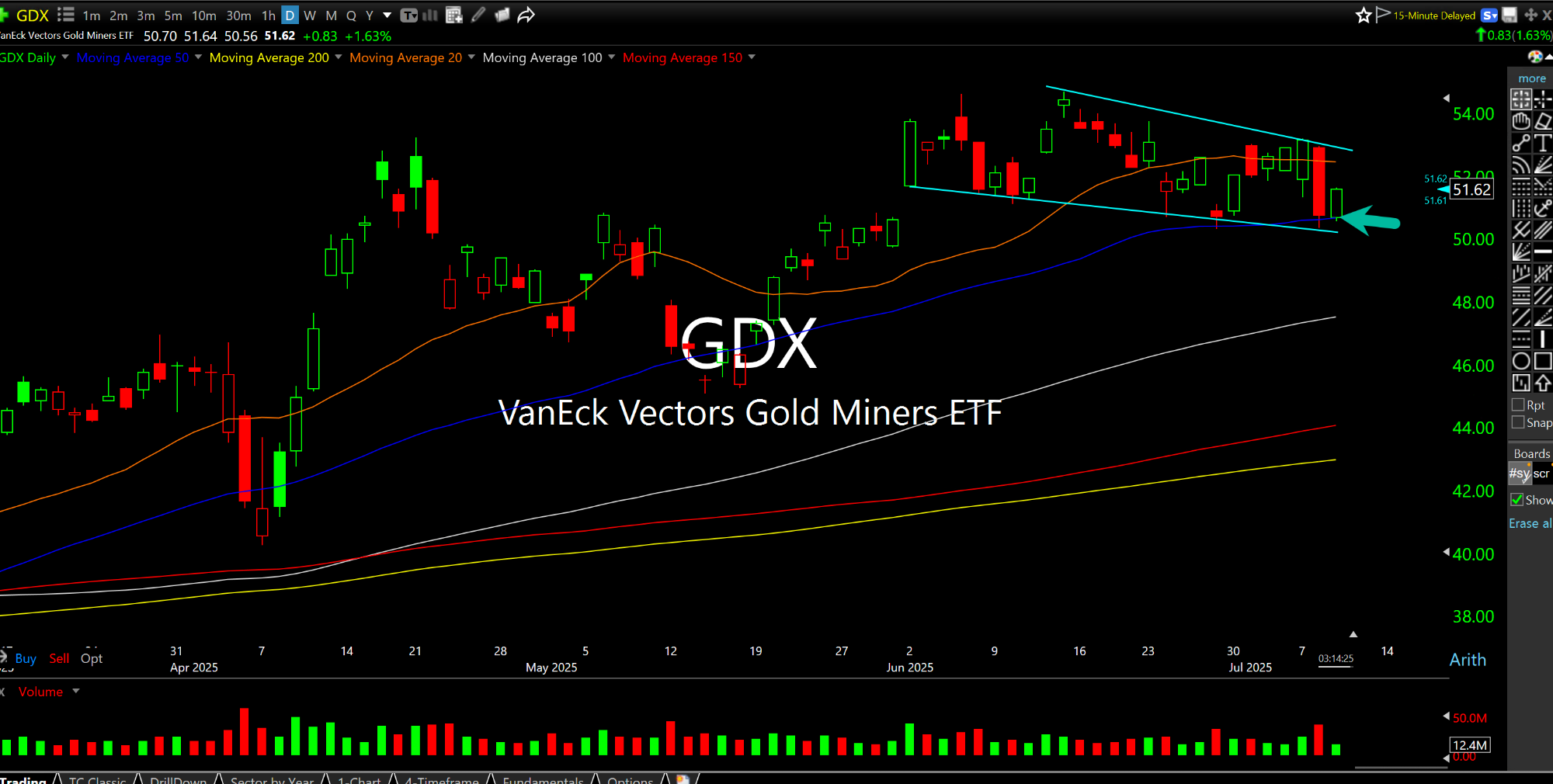

While far from sexy, still, compared to growth stocks, gold and the miners remain resilient in their bullish consolidations. Note the gold miner bounce today off the GDX ETF 50-day moving average, seen on the daily chart bleu with the dark blue line (50-day). August is typically a bullish month for gold. So, it would not surprise me to see a larger base form this month before a sustained new leg higher for gold and the miners into autumn.

Halitosis Ruins a Market Tha... REMX for the Bull Market Rem...