15Jul3:06 pmEST

Dress it Up as Much as You Like

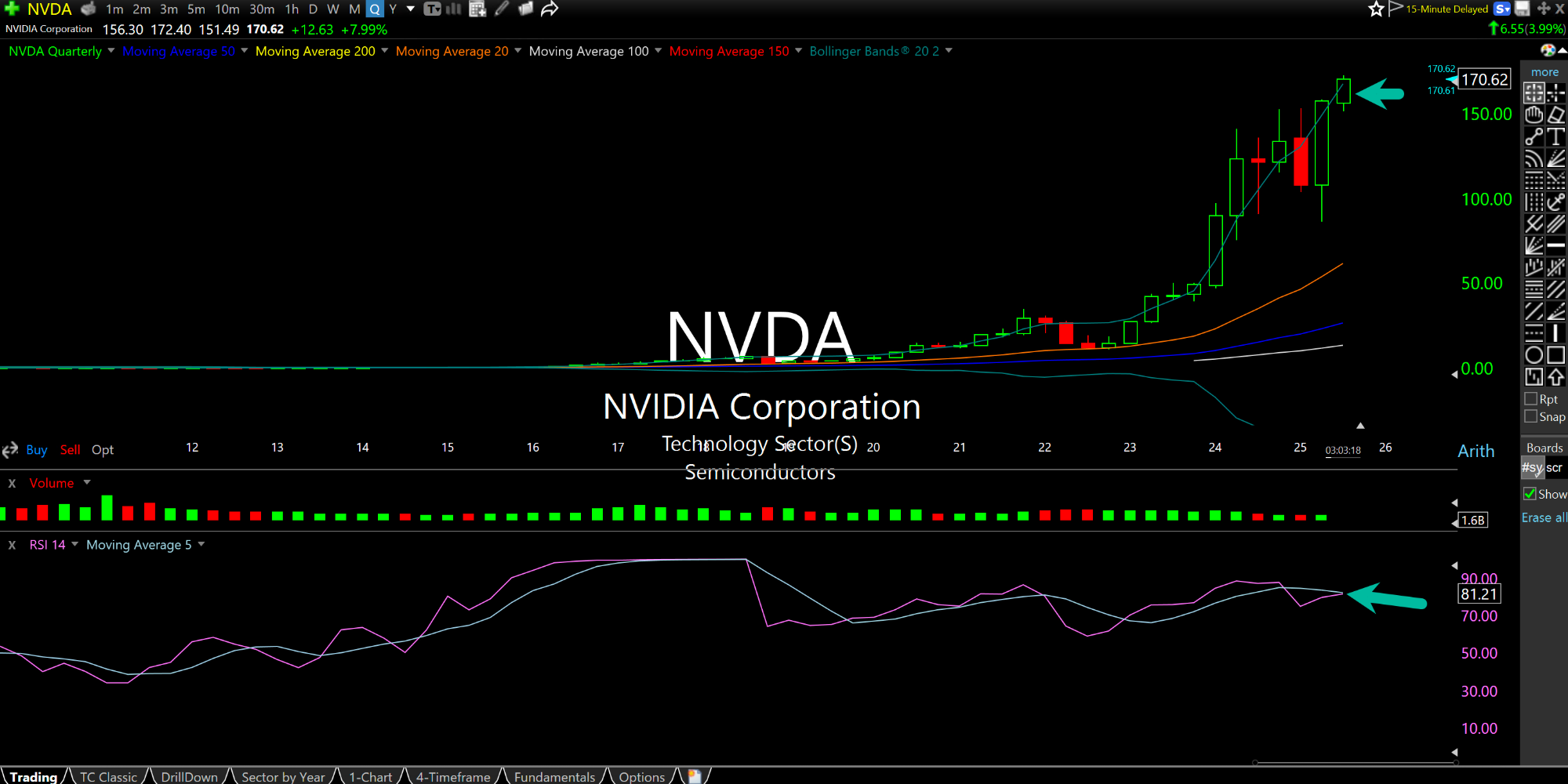

NVIDIA is still the main event for this market, with the $4 trillion market cap behemoth and current largest firm in the world surging again today on news they are selling some AI chips to China. On the quarterly NVDA chart, below, the comparisons to RCA in the 1920s and CSCO from the dot-com bubble still seem relevant. Note the bearish RSI divergence (bottom pane) on these latest highs, though that is clearly one of the things which does not matter until it does.

Still, it is worth mentioning it due to the fact that the bifurcation in this market continues to have the look and feel of a poker game where two or three players get all of the chips while everyone else is getting felted and scrambling to buy back into the game. Case in point: The small caps in the IWM are getting walloped today, down by nearly 1.5% as I write this off the CPI print this morning which sent rates higher.

On that note, higher rates are pushing back to levels where you may finally seem the White House get squeamish, such as the 30-Year back over 5%. On the 10-Year, I still believe a push above 4.5% which holds (it is almost there now) will be a significant development.

You can dress up the indices as much as you like with NVDA, just like you can dress up the economy with government spending. But anyone looking at the actual parts of the market and anyone dealing with most aspects of the real economy will tell you objectively this is not a healthy, thriving bull run.