16Jul2:22 pmEST

He Wasn't Right in the Head

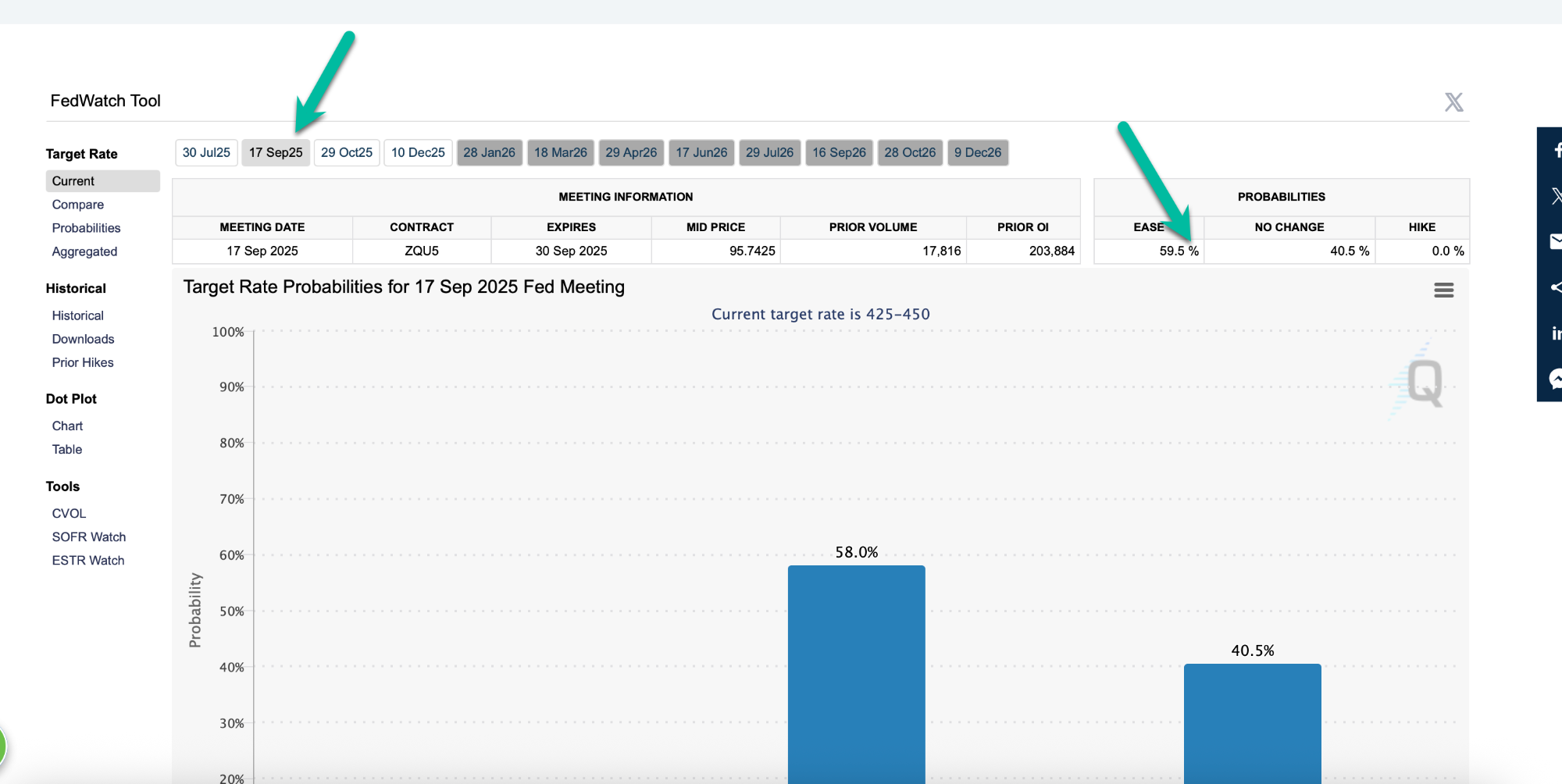

The odds of any Fed policy action in the FOMC later month are nearly zero. However, according to the CME FedWatch website, the odds of a rate cut at the September FOMC are currently just under 60%.

But those odds were significant higher not too long ago, up above 90% at one point.

Clearly, rates on the long end of the curve pushing higher of late have offset President Trump's nonstop media barrage against Powell to cut rates.

On the one hand, Trump is doing a brilliant job of controlling the narrative, making it seem as though it is not a question of "if," but "when," we get a rate cut, as opposed to even leaving a rate hike up to debate. On the other hand, a much-desired rate cut could be catastrophic with inflation beginning to turn back higher, not unlike the 1970s fiasco.

So who is not right in the head, Trump or Powell? Or both? Or, perhaps, I am the one misguided?

What we can say with more certainty is that the long end of the curve does not seem to be sniffing out imminent deflation at all--Just think about how many times the rates on the 10-Year Note have had the chance to break and hold below 4% in recent quarters yet failed to do so.

Gold, silver, and now platinum and palladium continue to point to a meaningful rotation into precious metals as a check on reckless monetary and fiscal policies, given the threat of another wave of inflation. As an example, rates on the 30-Year Treasuries have not budged today despite a cool PPI print. As I write this they are sitting comfortably at 5%.

As long as Trump keeps controlling the narrative of "when but not if" on rate cuts, I have to believe that all of the precious metals and derivative miners will continue to move higher and find rotation within the group as we are seeing now.

Sending Energy Bears Up the ... A Setup in Oil Which Would M...