22Jul2:17 pmEST

It's Funny...Up to a Point

Shares of D.R. Horton and Pulte Homes are rallying sharply after earnings and leading a sizable rally in homebuilder stocks at-large today. As I write this the XHB ETF is up more than 5.25%, a monstrous move for a sector ETF, with DHI and PHM the leaders up 15% and 10%, respectively.

Indeed, it seems like it is all fun and games for housing bulls, as they are claiming victory over the many housing skeptics. It also does not hurt that President Trump made headlines earlier about another potential tax break for home sellers.

However, the fun lasts up to a certain point, especially when we zoom out and look at longer-term timeframes.

For a while now we have tracked the relative and absolute weakness in housing stocks. Beyond that, housing related-retail names have struggled, be it HD LOW SHW, or even RH.

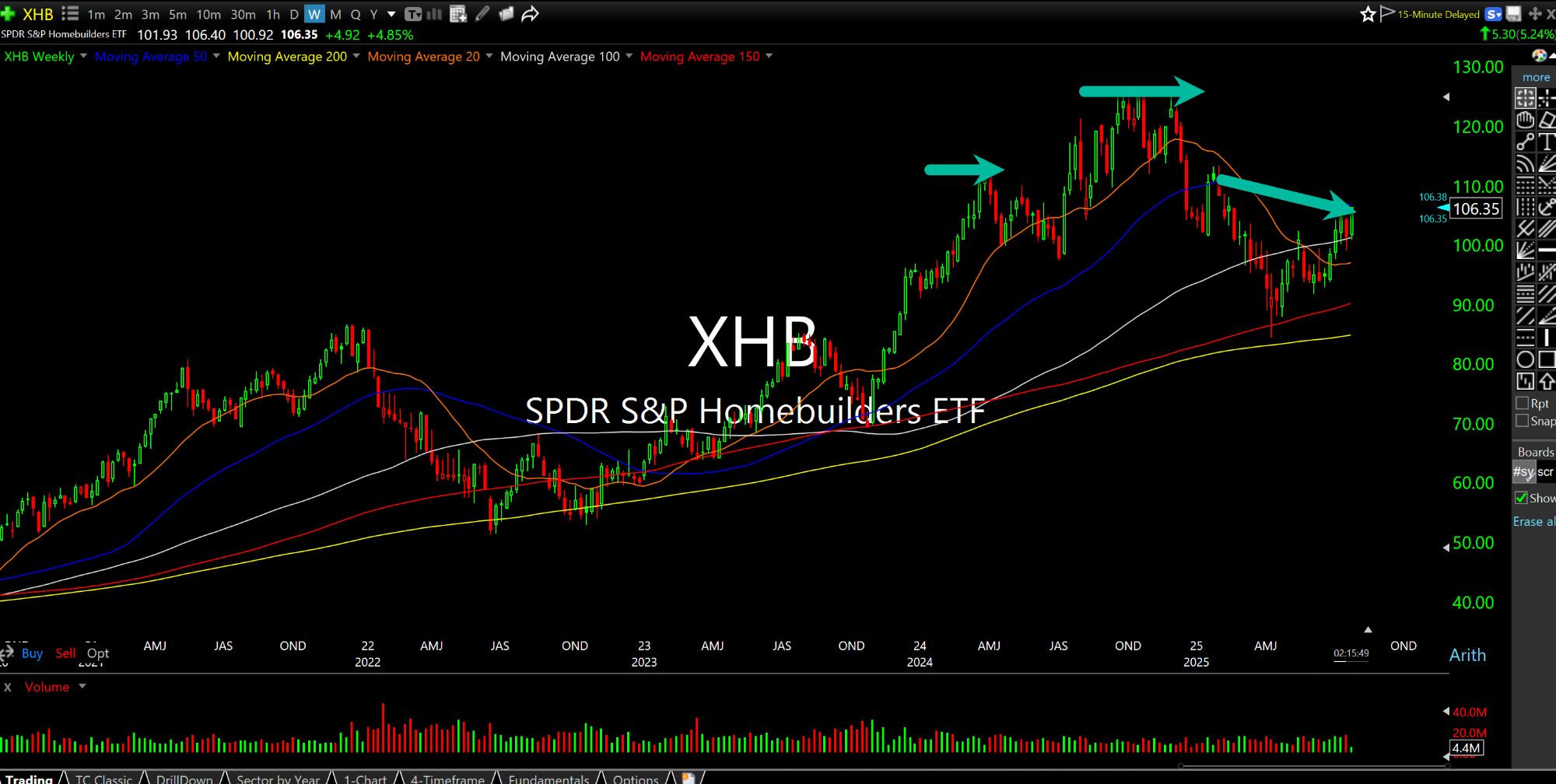

Thus, just because we have an exuberant rally on hopes the housing pullback is over does not mean we are off the races. Quite the contrary, as the XHB weekly chart, updated below, shows the current pop could easily be a "right shoulder" rally concluding a massive head and shoulders bearish topping pattern dating back to early-2024.

Fittingly, we have GOOGL earnings tomorrow evening. And while Alphabet is unrelated to housing, the GOOGL weekly chart has a similar setup to XHB.

But as far as the homebuilders go, today smacks of a hopeful squeeze more than anything else. It is unlikely any of Trump's ideas, even if enacted, would move the needle as much as expected given how overpriced housing is in many key regions.