16Sep2:18 pmEST

Welcome Back

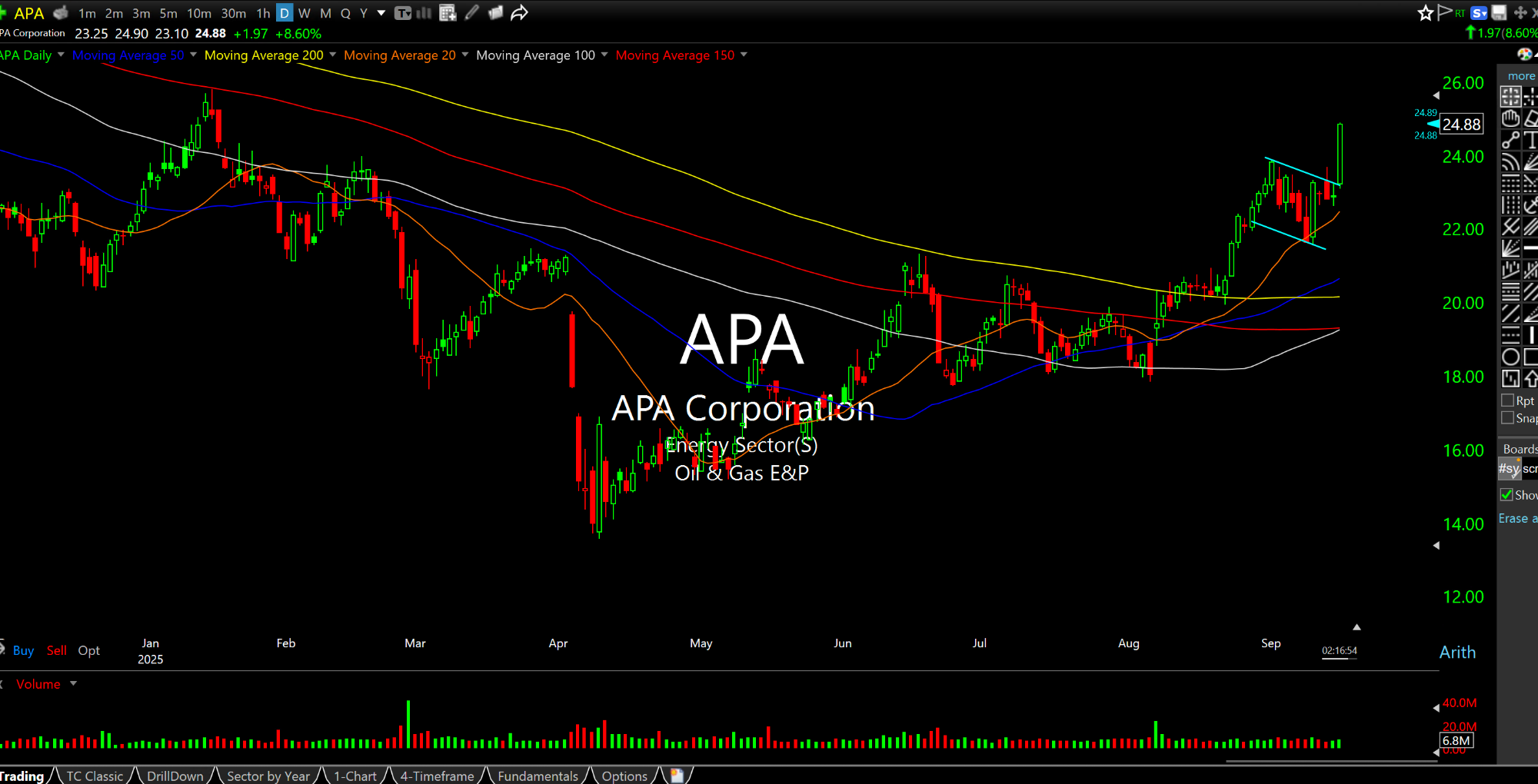

It seems fitting that APA Corporation (below on the daily chart), the holding company for energy exploration firm, Apache, is leading both the XLE and XOP oil stock ETFs higher today amid a strong session for crude oil and gasoline. After all, APA is one of the cheapest stocks by valuation in the entire market at this point, completely out of favor with the overwhelming majority of the retail and institutional investing communities like most commodity names have been.

Beyond that, you may recall that yesterday's piece on this website focused on the resurgence of gold, silver, and their derivative miners coming off extremely depressed valuations. Despite the recent strong rally most precious miners remain fairly cheap.

But if we are seeing a variation of the 1970s stagflation, as is my base case, then you will note that oil and gold were the two best performing asset classes by the end of that decade, and that the NIFTY FIFTY growth stock bubble had popped by 1973.

Thus, welcome back, oil.

Elsewhere, tomorrow's likely 25bps rate cut is clearly in focus for markets. This morning's strong retail sales data actually seem like a nonevent for most stocks, if not a mild sell-the-news reaction by names like COST and a bunch of retailers like ANF BURL GAP URBN, among others.

Still, the reaction to tomorrow's FOMC and presser will be the biggest issue going forward. If Powell indicates a new cutting cycle is only just beginning he had better hope that the long end of the curve does not push back like it did a year ago. In other words, if the market decides inflation is far from over, despite a cutting cycle, it should finally be the green light commodity (especially oil) bulls have been expecting for quite some tine.