22Dec1:50 pmEST

Christmas Week Drift

We have two and a half trading sessions this week before Christmas Day on Thursday, followed by what should be a ghost town of a full session on Friday. To be sure, plenty of market players have already closed up shop for this calendar year and are on holiday until January 5th, 2026. But for those sticking around we have identified some commodity-adjacent plays into 2026, noted with Members earlier today on our private feed on X.

With gold, silver, and rates in Japan hitting multi-decade or all-time highs there *ought* to be pressure on The Fed to reverse course with recent rate cuts and consider tightening. However, we know there is no such pressure from inside the Beltway just yet, especially from the White House which wants rates cut significantly lower from here. Even with rates on the 10-Year higher again there is just not much motivation from a lame-duck Powell to do much of anything.

I still suspect oil is a wildcard into 2026. With crude gapping up sharply today and Venezuela news intensifying there remain a risk, coupled with underweight positioning and negative sentiment, that oil surprises to the upside next year and spawns an inflation shock.

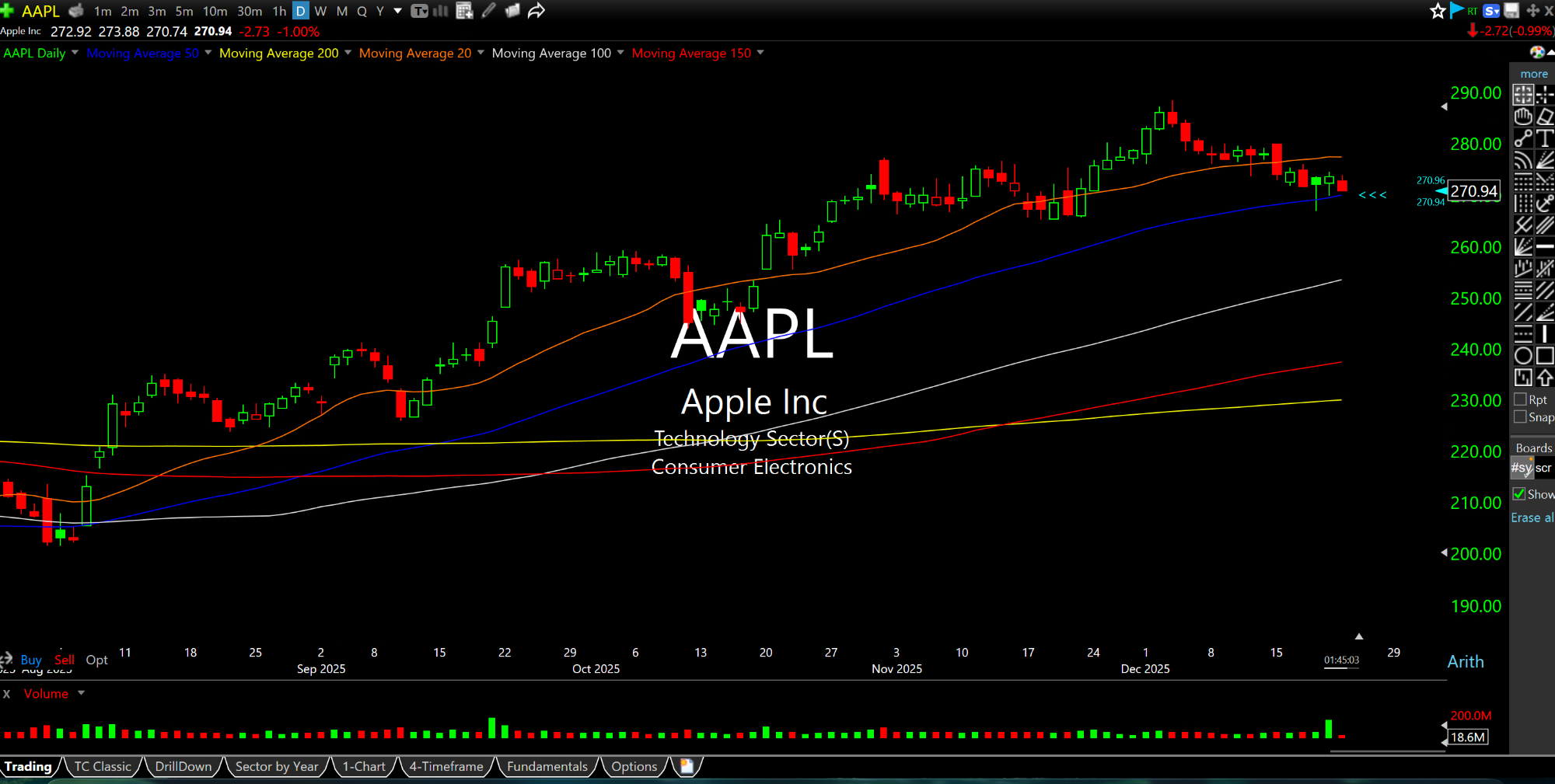

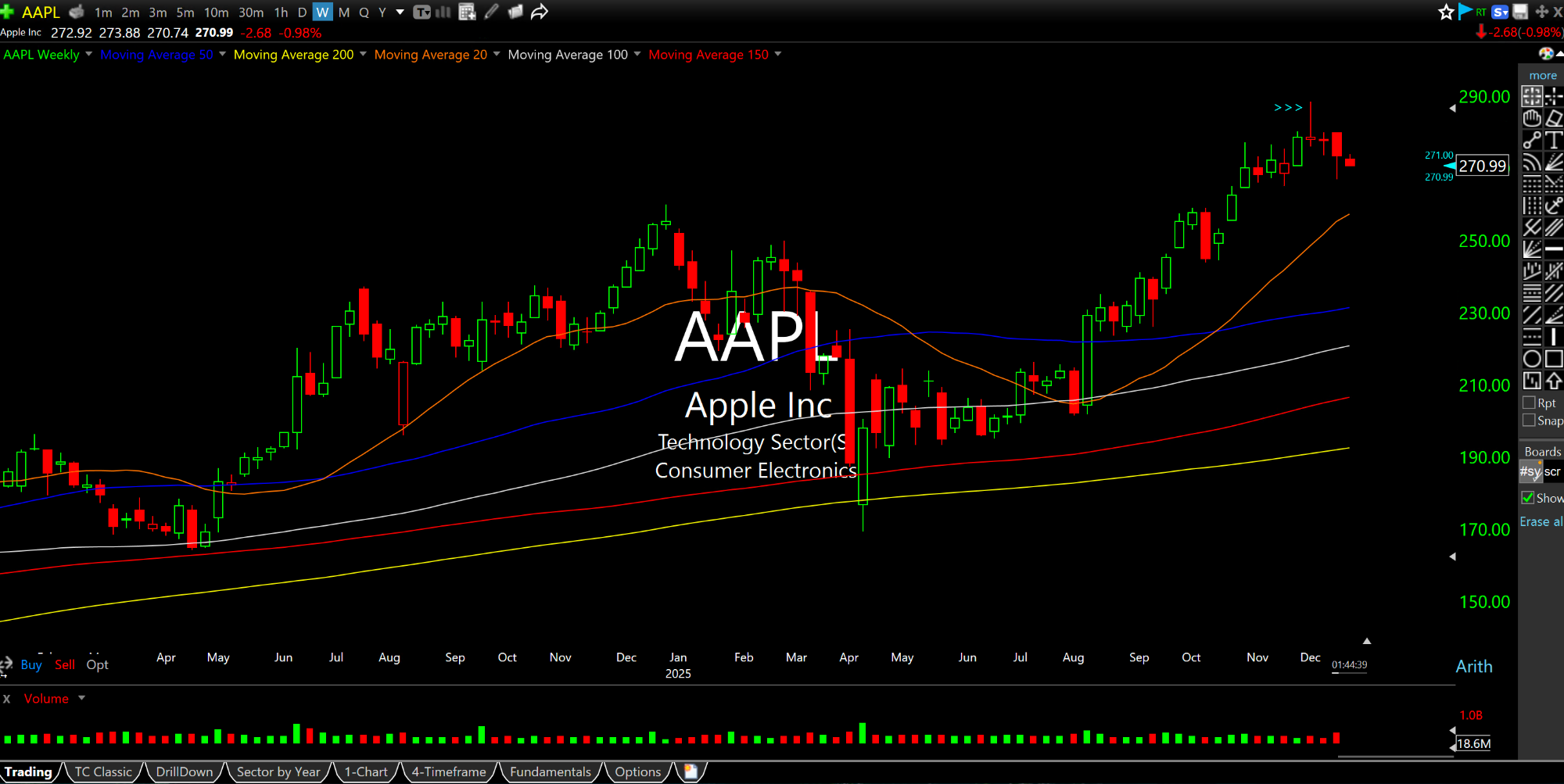

As for the tape today, Apple is a notable laggard. Combining the daily (first chart) and weekly (second chart) looks, below, we have topping action picking up steam, especially if the stock loses $270.

Afternoon Update 12/19/25 {V... Go to Australia for the Fina...