11Feb3:16 pmEST

Intrepid Rotations

Much like the oil industry we have not heard much from the farmers and agricultural complex with respect to equities for a good while now. All of a sudden, however, oil stocks have improved mightily in recent months and then we have large cap ag machinery plays like CAT and DE essentially going vertical.

Soft commodities in the ag space like soybeans, corn, and wheat, have also been out of favor for an extended period of time but are showing at least some signs of improvement with beans a relative leader.

As for ag stocks, Bunge (BG) was a name we highlighted for Members last year. And that name continues to operate impressively with a strong chart on all timeframes.

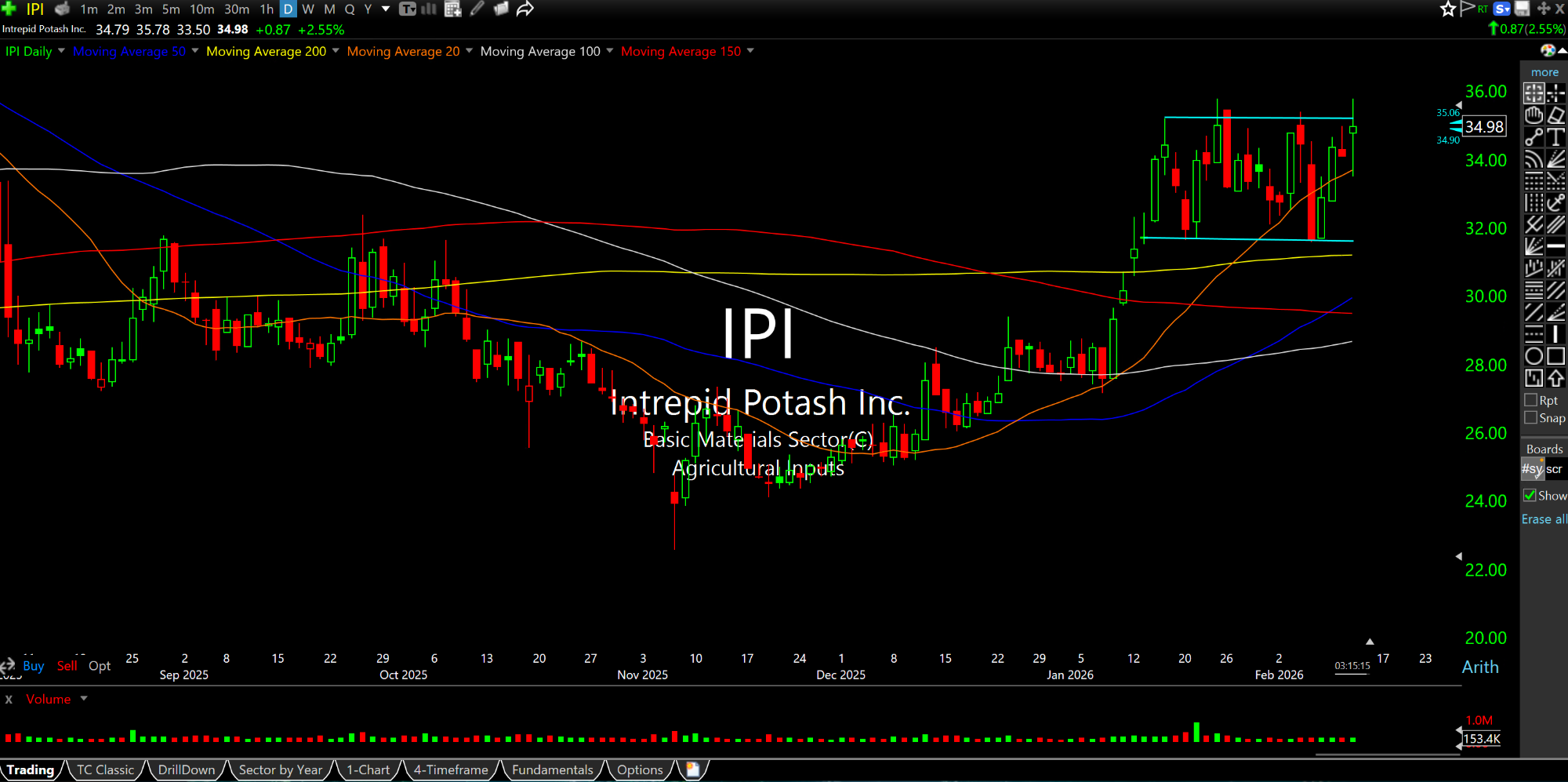

Another ag play on the come is Intrepid Potash, below on the daily chart forming a tight base after its recent push higher. In fact, there are several charts in the ag space that look just like IPI.

And similar to oil and the energy patch at-large, you can be sure just about all fund managers are laughably underweight ag plays since they have had to, instead, chase up tech and random flavor of the month growth stocks higher at any valuation for years on end.

On that note, the gist of today's tape is software giving up a chunk of its recent relief rally while the semis try to piggyback the Nasdaq once again.

Also note the LYFT earnings disaster, as UBER sells off in sympathy--Clearly that Super Bowl ad binge did not help. It really is all about the AI shell game holding everything up, as the rest of tech is middling at best.