03Dec4:19 pmEST

Don't Be Piggish on the Bounce Plays

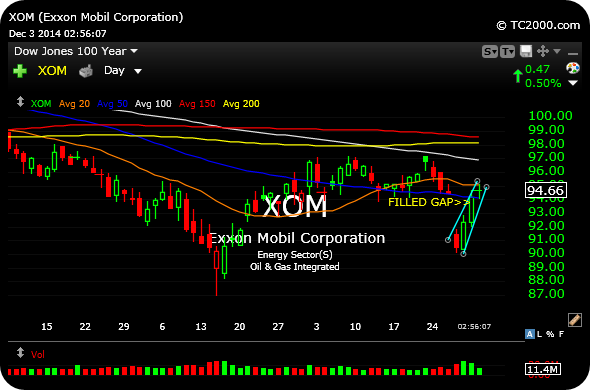

The energy sector bounce from oversold conditions in recent sessions has seen the likes of mega cap Exxon Mobil fill an open gap above, pictured on the first daily chart, below.

The issue then becomes where we go from here. On the second chart, below, of the daily timeframe of the energy sector ETF, we can see a mild fade off the highs of the session today.

Now that XOM has filled its gap, a rollover in the space becomes more viable this week, which means I am taking a reentry into the ERY bearish ETF more seriously.

A move back under $81.60 on the XLE makes the thesis even more viable.

Long story short (no pun intended), don't be piggish on these bounce plays in the energy patch, especially with crude oil soft today--These are still broken charts which are far from healed.

The energy sector bounce from oversold conditions in recent sessions has seen the likes of mega cap Exxon Mobil fill an open gap above, pictured on the first daily chart, below.

The issue then becomes where we go from here. On the second chart, below, of the daily timeframe of the energy sector ETF, we can see a mild fade off the highs of the session today.

Now that XOM has filled its gap, a rollover in the space becomes more viable this week, which means I am taking a reentry into the ERY bearish ETF more seriously.

A move back under $81.60 on the XLE makes the thesis even more viable.

Long story short (no pun intended), don't be piggish on these bounce plays in the energy patch, especially with crude oil soft today--These are still broken charts which are far from healed.

Flattening Out Into the Bell... Stock Market Recap 12/03/14 ...