17May3:52 pmEST

A Ceremonial Move

As much as some folks seem to desperately want to talk down commodities of late, the reality is that we could easily be in the throes of a deeper commodity bull run than many would expect. After all, as we have been profiling with the likes of natural gas and stocks like steel play X, many of these plays have been in bear markets or, at best, sideways ranges, for the better part of a decade.

Gold, silver, their miners, and oil plays are a bit further along nowadays, especially with the surge in the precious complex today. Coal plays are also catching strong bids all the while growth stocks in the Nasdaq are barely able to hold a bounce, if that.

Recall previous analysis where we noted even in 2008, which featured one of the epic most deflationary collapses after Labor Day of that year, we still saw a multi-month potent bull run in commodities and commodity stocks first.

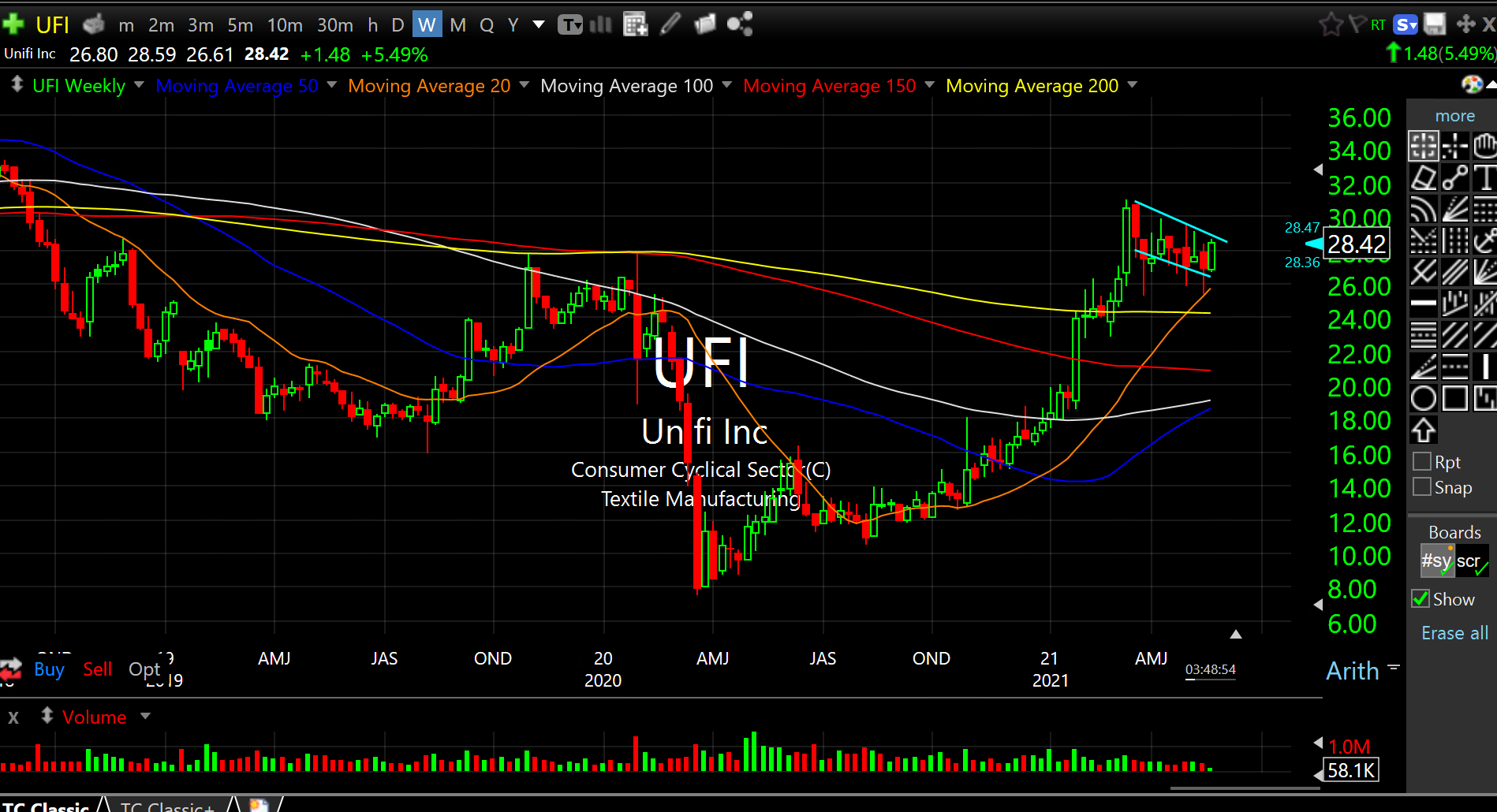

Thus, a name like Unifi, a polyester producer and an obvious alternate to cotton, seen below bull-flagging on its weekly chart, is an outside-the-box idea to consider in this spot, too.

Don't Underestimate This Cha... Summer Real Estate in Shortv...