10Nov10:37 amEST

They Have No Idea How Bad it is Right Now; None!

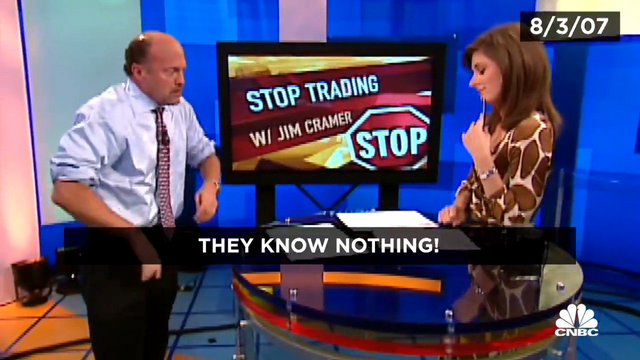

If ever there were a time for another Jim Cramer, "They Know Nothing" rant about The Fed, like we saw (below) in the summer 2007 as Cramer (correctly) discerned that deflation would eventually be the real culprit rather than inflation, now would seem to be it.

Only now the real issue is inflation, as evidenced by the red-hot PPI and now CPI numbers the last two mornings. For those inclined to be equity bulls almost all of the time, as Mr. Cramer tends to be, however, deflation becomes the larger menace to them in most cases. Inflation is often seen as a boogeyman who looms larger in our nightmares than in real life, but they may be because the real inflation boogeyman has not reared its head in over forty years.

However, that is changing now, in my view, as this inflation could easily spin out of control by the dead of winter. I expect calls for The Fed to raise rates far more quickly than their leisurely-paced timetable to become ubiquitous by around MLK Day in January. And I expect The Fed to acquiesce an announce they will raise sooner than later by mid-March 2022 FOMC, even if it is only a hard bluff to try to soothe markets at that point.

For now, as equities sort through these hot inflationary readings, gold and silver getting action is one of the main takeaway so far today. Also keep an eye on soft commodities, which you know I continue to be bullish on in most spots.

One phrase which is often uttered during inflationary times is that it is tough to put the inflation "genie back in the bottle once it gets out." I have not heard it mentioned too much lately, but I suspect we will hear a whole lot of it towards the holidays and early next year.

Who Needs the Wheat Belly An... Disney Earnings Tonight: Tra...