02Jun10:22 amEST

This is for Fighting, This is for Fun

The main point we have been stressing to Members of late has been that one must put into proper context and perspective all of the herky-jerky price swings the market has been sporting. In fact, one would almost think with the precision and the manner in which the buy and sell programs have been alternating that this were some kind of basic training marine exercise.

But this is the real world in markets, regardless of how we feel about it.

And even as the economic data point to a slowing economy and OPEC tries to drown the oil markets, the price action suggests otherwise in the near-term and bulls defend $305 on the QQQ and oil bulls show no fear of OPEC supply.

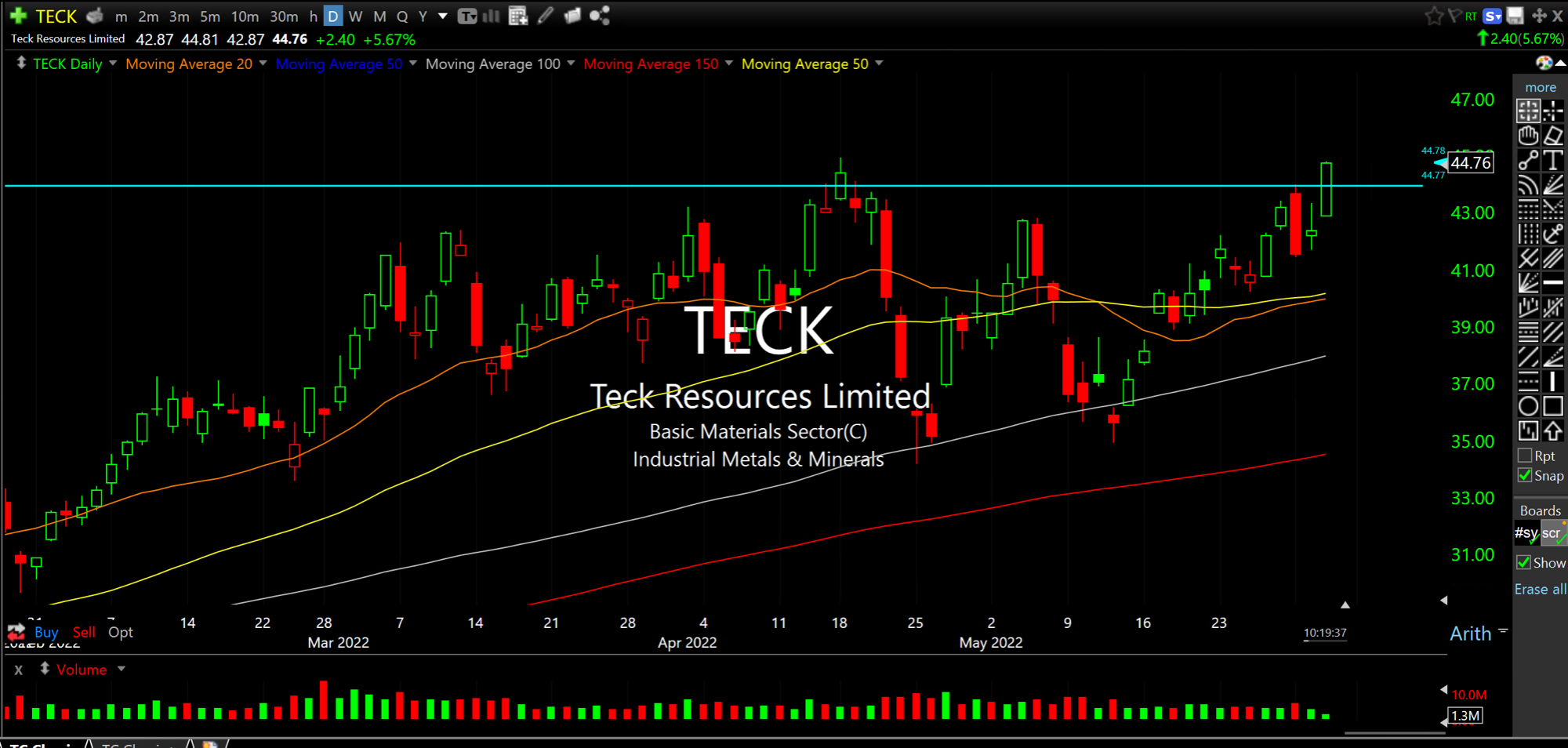

On that note, one of my few longs has been TECK, below on its daily chart going for a significant breakout. The basic materials miner has been as strong as any virtually any commodity name of late and should be a leader if the commodity bull has summer legs.

Overall, I expect more whipsaws as summer illiquidity and general indecision reign supreme. However, the bear market rally from late-May may have more to go before we arrive at a better entry to bet on the next meaningful leg down in the bear. Watch commodities for leadership clues.