13May2:42 pmEST

Inflation Bombs Away

Despite a cool CPI print this morning we have rates on the long end of the curve soundly higher. As I write this rates on the 10-Year Note are pushing over 4.5%. And, as we noted yesterday, a move to 5% still seems likely in the coming months. Given that this morning's inflation beat (or miss, depending on how you phrase it, either way a cool print) bond bulls fully expected a big rally in Treasuries with rates falling sharply. Instead, rates are up and TLT is looking incredibly bearish on literally every single timeframe, likely closing in on a major washout lower.

While the Nasdaq is happily ignoring this development for now, as rates move higher I still expect that to change.

In the meantime, oil and other commodity stocks are showing some life. Nuclear stocks, in particular off this Trump news, are surging today, with SMR OKLO among the big movers.

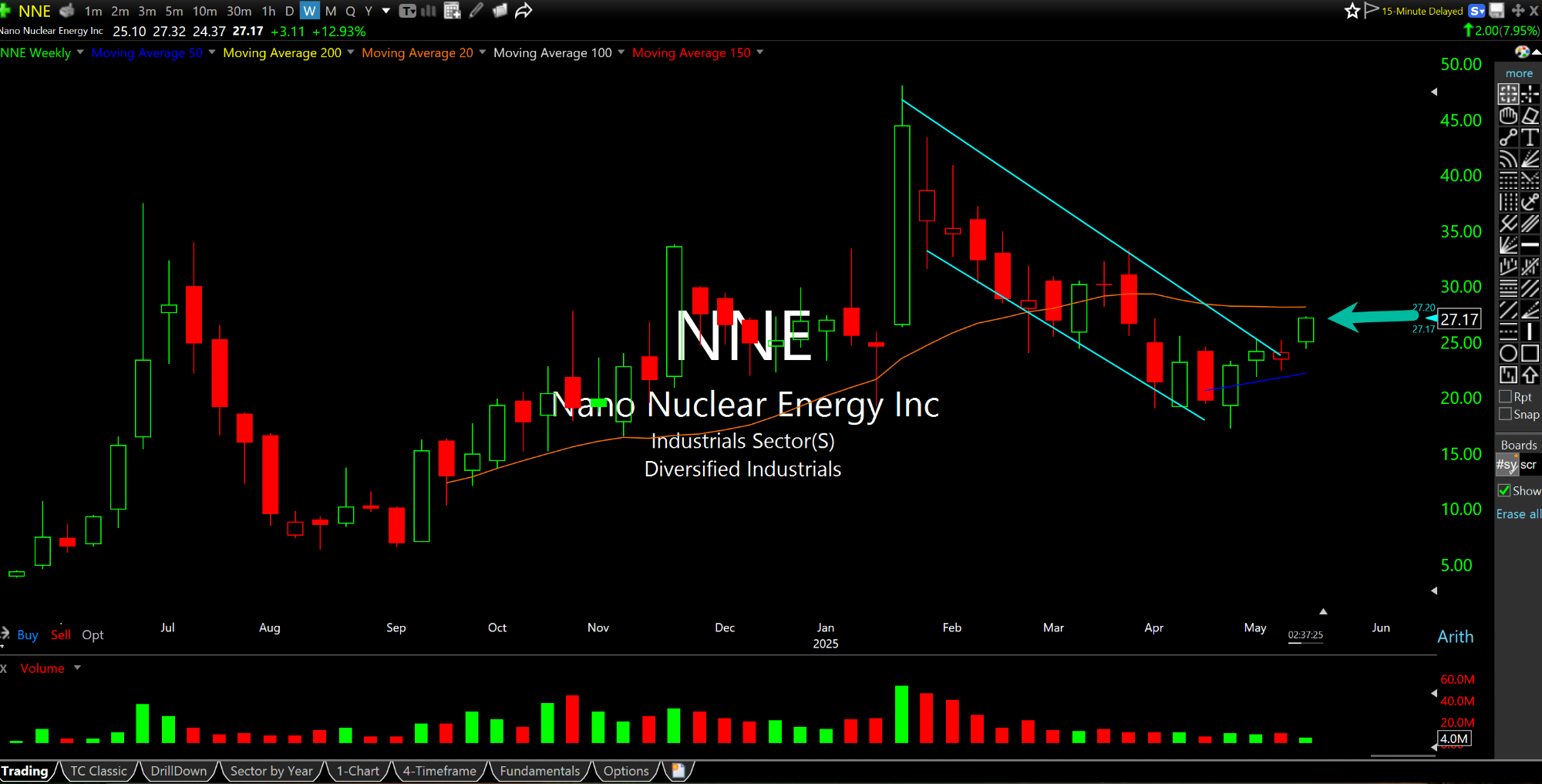

NNE, below on its weekly chart, is up more than 7% today. However, the move may just be getting started, as you can see the falling channel upside breakout dating back to January.

There Still Ain't No Free Lu... Everyone Loves a Comeback, E...